GOLD HITS 7-YEAR HIGH ON CORONAVIRUS FEARS, BITCOIN PUMP NEXT?

Story by: CHRISTINA COMBEN

The highly contagious coronavirus is racking up more cases outside of China and causing stock markets to tumble. As a result, investors are shifting to safe haven assets such as U.S. government bonds and gold, but Bitcoin has yet to budge.

As Italy imposed a strict quarantine on 10 towns after confirming 152 cases of the coronavirus, European equities opened lower this Monday.

The Stoxx 600 fell by as much as 3%, marking its heaviest sell-off since the end of 2018. Meanwhile, Germany, France, and Britain’s stock markets followed similar patterns.

The downward spiral in European stock markets echoed investor fears in the Asian region. Seoul’s Kospi also experienced its worst day since late-2018, dropping by 3.9% amidst steadily rising cases of the coronavirus in South Korea.

A massive surge in cases of the coronavirus globally now includes Iran, Europe, the Middle East, and South Korea. This is intensifying investors’ fears about its global impact.

Quoted in the Financial Times, Chief Asia-Pacific economist at ING Robert Carnell, said:

Markets [are] likely to show extreme caution in the face of [the] global spread of the coronavirus — this is no longer solely an Asia issue.

GOLD HITS 7-YEAR HIGH – WHEN BTC PUMP?

Unsurprisingly as the stock markets jittered, traditional haven assets saw gains. Gold, in particular, rallied by 1.5%, taking its price to a seven-year high.

We’ve seen BTC make substantial gains during the US-China trade war or tensions in Iran for example. Moreover, upon the initial news of the coronavirus outbreak, bitcoin saw increased volatility.

If the fears continue to rise then, is a bitcoin pump incoming?

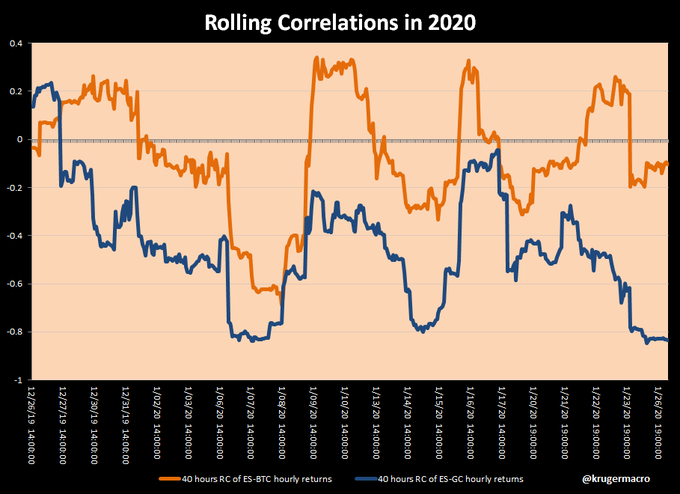

Possibly. Analyst Alex Kruger found bitcoin’s reaction to macro circumstances “extremely bullish” last month. He also pointed out, however, that bitcoin is still “in the process of becoming a macro asset,” so a spike in BTC price is not guaranteed just yet.

Original story: https://bitcoinist.com/gold-hits-7-year-high-on-coronavirus-fears-bitcoin-next/