BlackRock & Coinbase Deal Could Trigger Bitcoin Burst to $773,000 says InvestAnswers

A popular crypto analyst is breaking down how the partnership between two financial giants could trigger a Bitcoin (BTC) explosion to $773,000.

Last week, US-based crypto titan Coinbase announced that it teamed up with BlackRock, the biggest asset manager in the world, to bring cryptocurrency trading to wealthy clients.

In a new strategy session, the host of InvestAnswers tells his 443,000 YouTube subscribers that the partnership could boost Bitcoin’s market cap by a trillion dollars at the very least.

“If BlackRock puts 0.5% of their assets under management into Bitcoin using my multiplier which is 21x, that will impact the market cap by $1.05 trillion, which will add about $75,000 to Bitcoin’s price, taking it to $98,000, and an ROI (return on investment) from today’s price is 326%. This is very, very achievable…

Now if they allocate 1%, which of course will take time to get to that level, that would add about $2.1 trillion to the market cap, $150,000 to the price, and that would take the future price of Bitcoin to $173,000, which is a 652% gain from here.

If they add 5%, which is what Dan Tapiero says, I think it’s way too aggressive. Maybe over time, maybe in the next three to five years, that could be possible. That would take the price of Bitcoin to $773,000 in the next three to five years pretty easily.”

The crypto strategist’s analysis was inspired by comments from 10T Holdings CEO Dan Tapiero. According to the prominent macro investor, the deal between BlackRock and Coinbase could propel Bitcoin above $250,000,

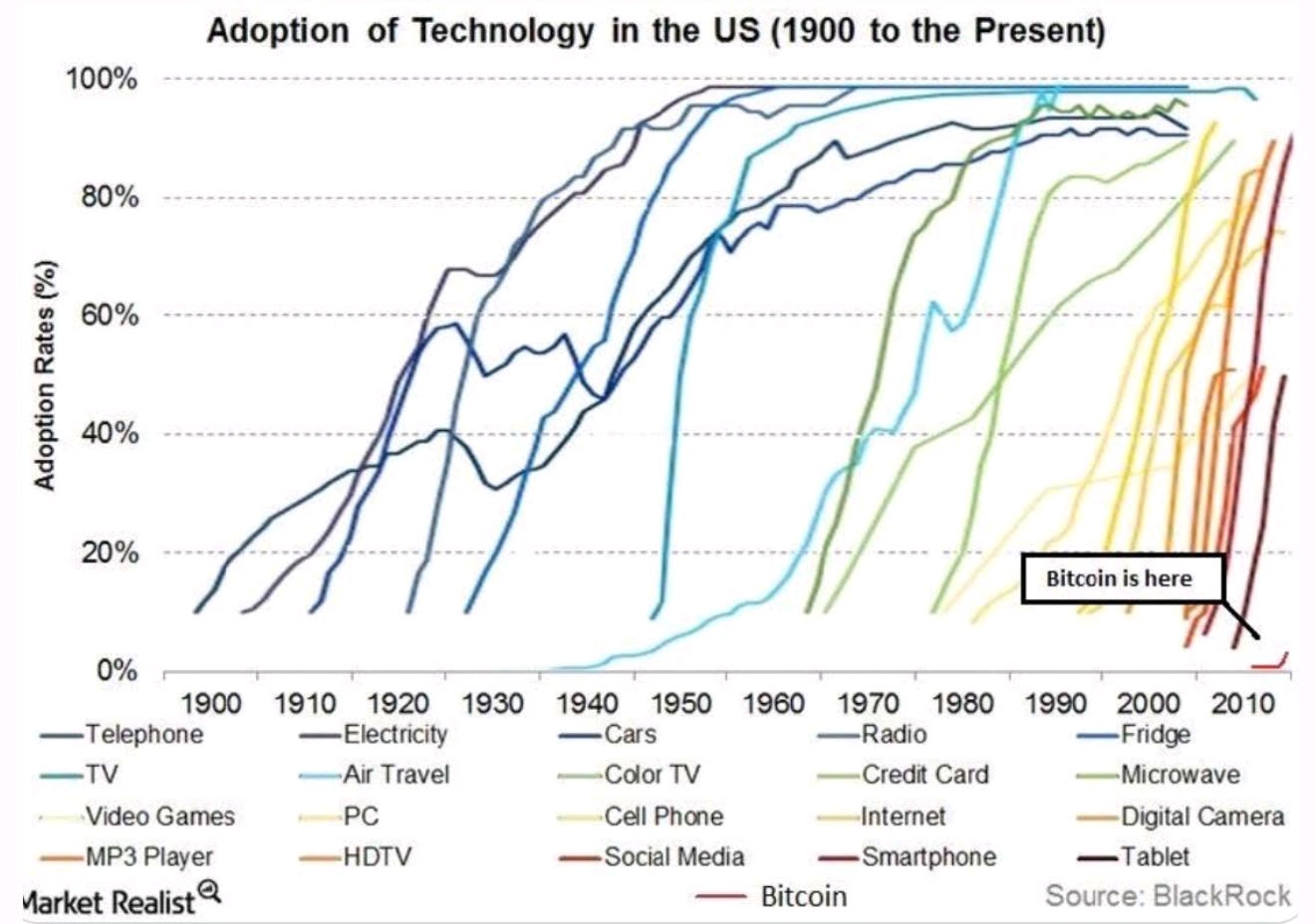

“Chart that got BlackRock excited about partnership with Coinbase!

No bigger a macro opportunity for BlackRock than acting to facilitate Bitcoin adoption. [A] 5% shift in BLK assets is $500 billion, greater than BTC value today. Catalyst for path to $250,000+ post BTC halving becoming clear.”

Via:The Daily Hodl