Bitcoin Moves Sharply Lower Again As Other Major Cryptocurrencies Go Into Free Fall

Story by: Billy Bambrough

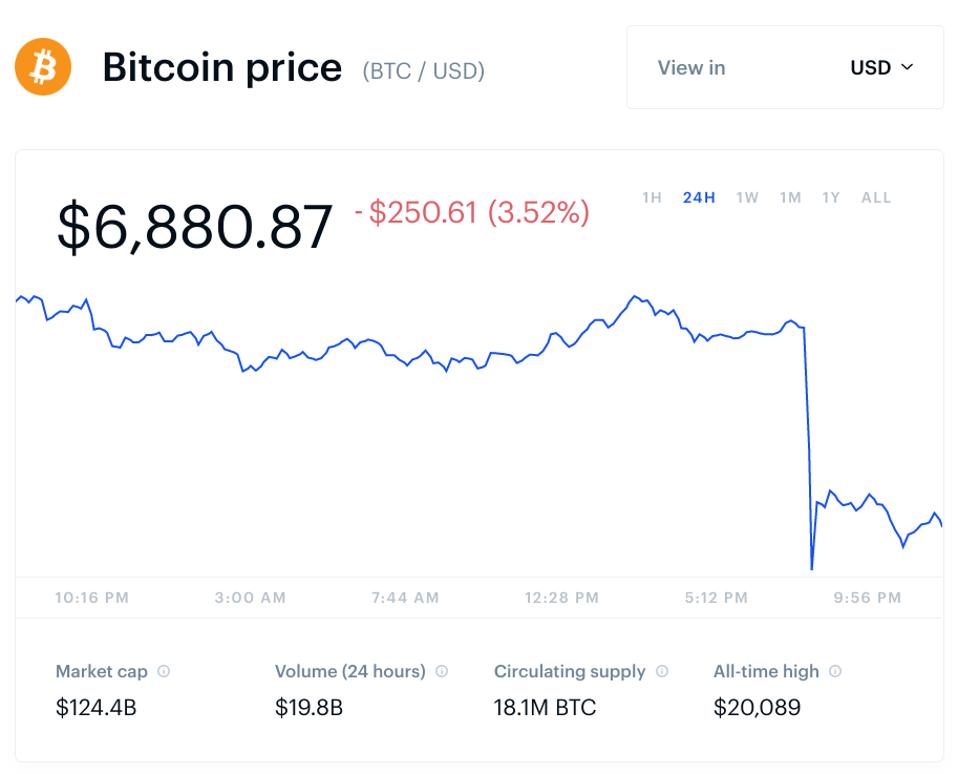

Bitcoin and cryptocurrency markets have been suddenly sold off, with the bitcoin price losing around $200 per bitcoin in minutes and dipping under the psychological $7,000 mark once again—continuing a period of relative volatility for digital tokens.

Bitcoin-rivals ethereum, Ripple’s XRP, bitcoin cash, litecoin, EOS and binance coin were also heavily sold off, wiping billions of dollars from the combined cryptocurrency market capitalization.

[Update: 9:10am EST 12/17/2019] Bitcoin, which yesterday dropped by 3.5%, has moved lower again, dropping over 5% since this time yesterday and trading as low as $6,708 per bitcoin on the Luxembourg-based Bitstamp exchange after briefly recovering ground overnight. Altcoins ethereum, Ripple’s XRP, bitcoin cash, litecoin, EOS and binance coin were last seen down between 7% and 11% and look to be heading lower.

The bitcoin price has been swinging wildly over recent months as traders and investors try to guess … [+]

SOPA IMAGES/LIGHTROCKET VIA GETTY IMAGES

The cause of the sudden sell-off was not immediately clear, however, analysts have noted a drop in crypto market trading volume recently.

“All is quiet on the crypto front. Perhaps, a little too quiet,” Mati Greenspan, the founder of bitcoin and crypto research outlet Quantum Economics wrote in a note ahead of the bitcoin sell-off today, adding the dominance of the world’s biggest stablecoin, tether, “seems to be waning.”

Bitcoin was earlier trading at $6,880, down by 3.5% over the last 24-hour trading period, according to prices from U.S.-based crypto exchange Coinbase, with ethereum, Ripple’s XRP, litecoin, and bitcoin cash all off by between 5% and 8%.

PROMOTED

EOS, a dectralized app token similar to ethereum, led the bitcoin and crypto market lower.

Earlier this year, bitcoin and cryptocurrency price watchers warned that “dismal” bitcoin volumes could mean the market was headed for a perfect storm.

In periods of low trading volume, crypto prices are more vulnerable to so-called whales moving the market by placing massive buy or sell orders at a little above or below current market rates. These can trigger trading algorithms that then send prices sharply higher or lower and can be a sign of market manipulation.

Meanwhile, research out earlier today suggested the bitcoin price might struggle over the short term due to the $2 billion PlusToken scandal—one of the biggest ever cryptocurrency scams.

The bitcoin price hasn’t fallen below $7,000 since the end of November and its sudden fall knocked … [+]

COINBASE

“That’s certainly something to consider when you are thinking about where the price is going, at least in the short term,” Kim Grauer, senior economist at blockchain analysis company Chainalysis told financial newswire Bloomberg. “It could be, according to our research, continued downward pressure.”

PlusToken scammers are thought to have sold some 25,000 bitcoin, according to Chainalysis data, with a further 20,000 still to be dumped back onto the market.

Original story: https://tinyurl.com/t4a5xw6