The reasons behind Bitcoin’s bullish turn

Story by: Ross Chalmers

Bitcoin’s performance over the past month or so has been quite remarkable. After languishing in the doldrums around the low $3,000 mark, we are now on the verge of seeing a return of the Vegeta memes as we near $9,000.

Most traders who voice their opinions on Twitter are awash with bullish sentiment. As are most people in the space, in fact.

However, Tone Vays has stuck to his guns in saying that he expects a severe pullback. Many have ridiculed him on this issue, especially as the market continues to climb higher. After speaking to Tone in Malta, we discussed how he expected the bear market to crush altcoins much more than they had been.

Whilst many altcoins have suffered in the bearish market, they are still at much greater highs than they ever saw in 2016. Retail investors who flooded money into altcoins have either been left bagholding or taking significant losses.

What has caused the recent price movement?

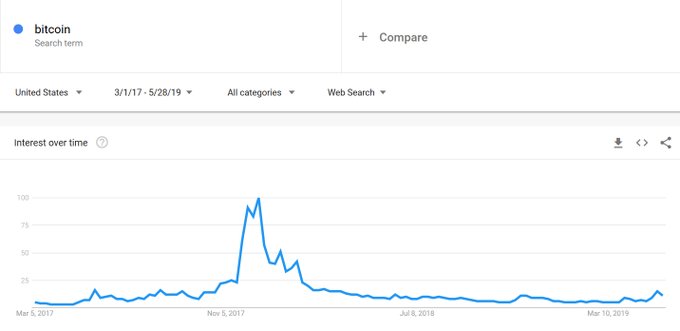

Whenever Bitcoin rises in price, commentators are quick to guess what the underlying reasons are. The last time Bitcoin saw its current price, there was a massive wave of interest from the retail market. Mainstream news outlets were writing articles and everyone was talking about it.

As you can see from the chart above though, the interest from retail investors appears to be very small this time around. For the most part, Bitcoin’s recent upward move has gone under the radar outside of the crypto community.

Other factors that have been suggested are the troubling geopolitical economic worries. The current China and US trade war shows no sign of slowing down and has been cited as one reason for increased interest in Bitcoin. Another is the Brexit chaos taking hold of the United Kingdom right now.

The idea that such incidents could effect Bitcoin shouldn’t be dismissed immediately. The Cypriot financial crisis during 2012 and 2013 gave Bitcoin a shot in the arm as people saw it as an alternative to banks.

Potential pitfalls

Questions can be raised as to whether the cryptocurrency market has matured during the bear market. Whilst ICOs have faded into obscurity, they have been replaced now with IEOs instead. A top cybersecurity expert in Malta stated that he viewed the vast majority of ICOs as useful money laundering tools.

Since cryptocurrency exchanges have lost a large amount of income from listing fees, IEOs are another way to boost their profits. It seems unlikely that the SEC will look upon IEOs more favourably than ICOs though.

Progress has also been made with the scaling of Bitcoin with the Lightning Network. Is the network ready for an increase of activity on a scale not seen before? Is the Lightning Network in a state for technophobes to use? Both of these questions will not be answered until we see retail investors return to the cryptosphere.

Conclusion

The majority of people in the cryptocurrency industry have once more turned bullish on the price of Bitcoin. This won’t necessarily mean that more price movement upwards will be easy, as there could still be many significant pullbacks.

The most interesting time will be when the mainstream media once more picks up on the price movement and retail investors come back to flood the market.