Bitcoin Value Indicator – September 2018

Story by: Hans Hauge

Summary

All indicators were up in the month of August, and the average price of Bitcoin was slightly down.

Segwit and the Lightning Network have seen massive gains in usage this year.

While Bitcoin looks like a better buy this month, the market cap of Bitcoin is still higher than predicted.

This idea was first discussed with members of my private investing community, Crypto Blue Chips. To get an exclusive ‘first look’ at my best ideas, subscribe today >>

Introduction

If this is your first time reading a Bitcoin (BTC-USD)(COIN)(OTCQX:GBTC) Value Indicator report, you may want to refer to the original article to catch up.

Signal Breakdown

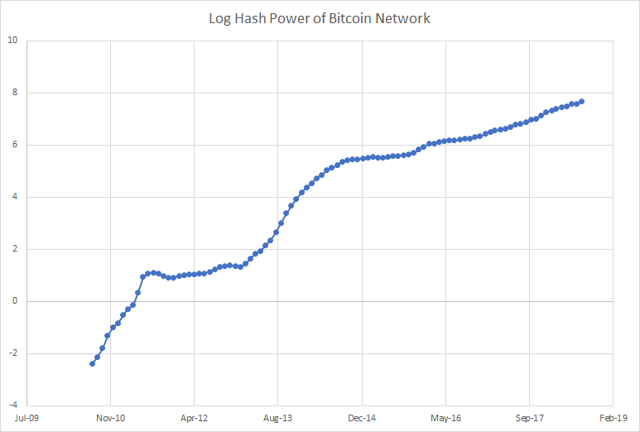

First, we turn our attention to the hash rate of the network. I’m using the long view here, and as you can see, the Bitcoin miners have yet to even blink, despite the fact that the Bitcoin price has been falling since December/January. Some of this is delayed investment from 2017, but it should be considered a good sign that companies are still moving dirt and installing new equipment (companies like Hut 8 Mining (OTCQX:HUTMF), that I recently wrote about for example).

Hash Rate

Data Source: blockchain.com

Data Source: blockchain.com

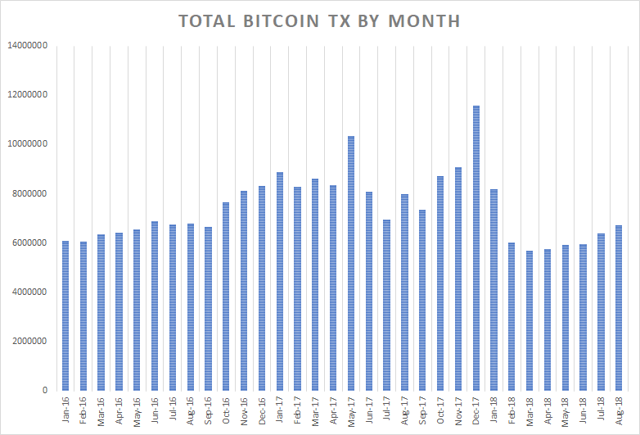

Total Transactions

The total number of Bitcoin transactions increased at a steady clip in the month of August. As I pointed out last month, monthly transactions bottomed out in March and have been increasing ever since. August was no exception and represented the fifth month of increases in a row.

Data Source: blockchain.com

A growing pile of transactions means that people are still using Bitcoin, despite the downturn in the price and all the negative press. With less speculators in the market, the remaining activity should be seen as a very positive sign. The actual user base of Bitcoin is growing again.

Original story: https://seekingalpha.com/article/4204147-bitcoin-value-indicator-september-2018