BITCOIN TRANSACTION FEES HIT SEVEN YEAR LOW

Story by: ANTHONY CUTHBERTSON

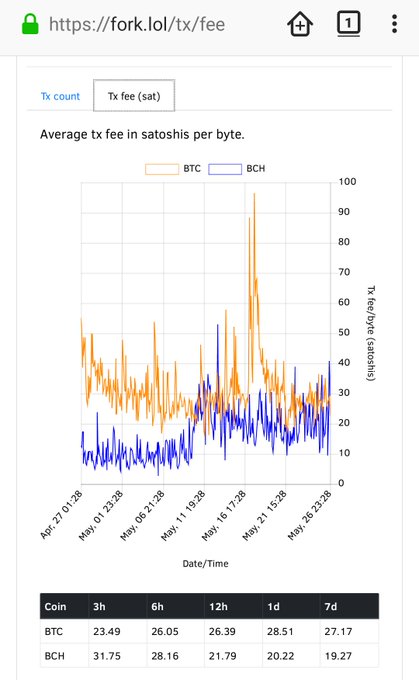

Bitcoin transaction fees have hit a seven year low, potentially opening up the cryptocurrency to much wider uses as an actual currency.

When bitcoin’s pseudonymous creator Satoshi Nakamoto first described it in a 2009 paper, the cryptocurrency promised to be a “peer-to-peer electronic cash system”.

As its popularity grew, however, its overloaded network became plagued with slow transaction times and high fees, reaching as high as $60 per transaction at the end of 2017.

According to one transaction fee tracker, this figure has since fallen more than 70-fold.

The issues with slow transactions and high fees led to an irreparable rift among the bitcoin community, eventually leading to a split in bitcoin’s underlying blockchain technology to form a brand new cryptocurrency: bitcoin cash.

Bitcoin cash aimed to overcome the problems by altering the way transactions are processed.

While bitcoin transaction fees remain erratic, they briefly dropped below those of bitcoin cash last Sunday.

The fall in bitcoin transaction fees has coincided with a dramatic drop in the price of bitcoin cash, which has lost around half of its value since the beginning of the month.

It is already possible to pay for goods and services with cryptocurrencies like bitcoin and ethereum through third-party platforms that convert digital currencies into fiat currencies like pounds and dollars to facilitate the transaction.

One such platform is Plutus, which allows people to pay using bitcoin and ethereum through NFC-enabled payment terminals around the world.

According to the cofounder and CEO of Plutus, Danial Daychopan, bitcoin’s popularity has already pushed it into the mainstream as a speculative investment opportunity. As its practicality improves as a currency, mainstream adoption will likely spread beyond “mom and pop” investors.

“Bitcoin is not only a unit of account like gold, it is also a unit of exchange, which gold isn’t,” Mr Daychopan told The Independent. “The future of bitcoin is in everyday spending, not just investment.

“That being said, we predict that bitcoin will reach £30,000 by the end of the year and around £50,000 by the end of 2019.”

This price volatility is exactly the same reason why some believe that bitcoin is still a long way from being adopted as a currency on any significant scale.

Original story: https://tinyurl.com/ycj6j69s