Bitcoin Price Teeter as US Stock Market Digests Trump’s Shutdown Deal

Story by: Josiah Wilmoth

The Dow Jones Industrial Average and broader US stock market teetered on the brink of their previous-day closes heading into the week’s final trading session. Wall Street continued to digest the fallout from Trump’s decision to sign a new spending bill and avoid a second government shutdown – while also declaring a national emergency to siphon funds from other departments to bolster his beloved border wall. Similarly, the bitcoin price traded within a tight window as traders waited with bated breath to see which way the cryptocurrency market would break.

DOW FUTURES TRADE UP AHEAD OF THE OPENING BELL

As of 9:02 am ET, Dow Jones Industrial Average futures had climbed 94 points or 0.37 percent, implying a jump of 85.61 points at the open. Dow futures implied a flat open for much of the pre-market session but rallied in the hour before the opening bell.

S&P 500 futures and Nasdaq futures also pointed north, with the two indices implying gains of 9.32 points and 27.58 points, respectively.

On Thursday, historically-weak retail sales data crushed a pre-bell futures rally and threw all three major US stock market indices deep into the red. The Dow fell 103.88 points or 0.41 percent to 24,439.39, while the S&P 500 dipped 7.3 points or 0.27 percent to 2,745.73. The Nasdaq, on the other hand, clawed its way back into neutral territory to close at 7,426.96 with a 0.09 percent gain.

This morning, Wall Street continues to mull the ramifications of a US congressional spending bill that will fund the federal government and avoid a costly second shutdown. Crucially, the White House has indicated that President Donald Trump will sign the bill, even though it only allocates $1.375 billion toward border wall funding, far short of the $5.7 billion he had requested.

While averting a second shutdown is an unqualified win for the stock market, Trump introduced a degree of uncertainty by indicating that he would also declare a national emergency. The White House says this will allow him to redirect billions of dollars from the Treasury and Defense departments to the border. However, the Trump administration will likely face a pitched legal battle that could extend throughout much of the remainder of his term.

INSTITUTIONS HEAVILY FAVOR BITCOIN

The cryptocurrency market also showed few signs of life heading into the US trading session. In fact, very little has happened at all since Feb. 8 when the bitcoin price made a sudden spike above $3,700.

While bitcoin continues to trade in a tight range, analysts wait for it to make a breakout. The only question is: which way will it move?

In the meantime, the relative silence in the crypto market gives us a chance to look at some broader industry trends and what they might tell us about the ecosystem’s future landscape.

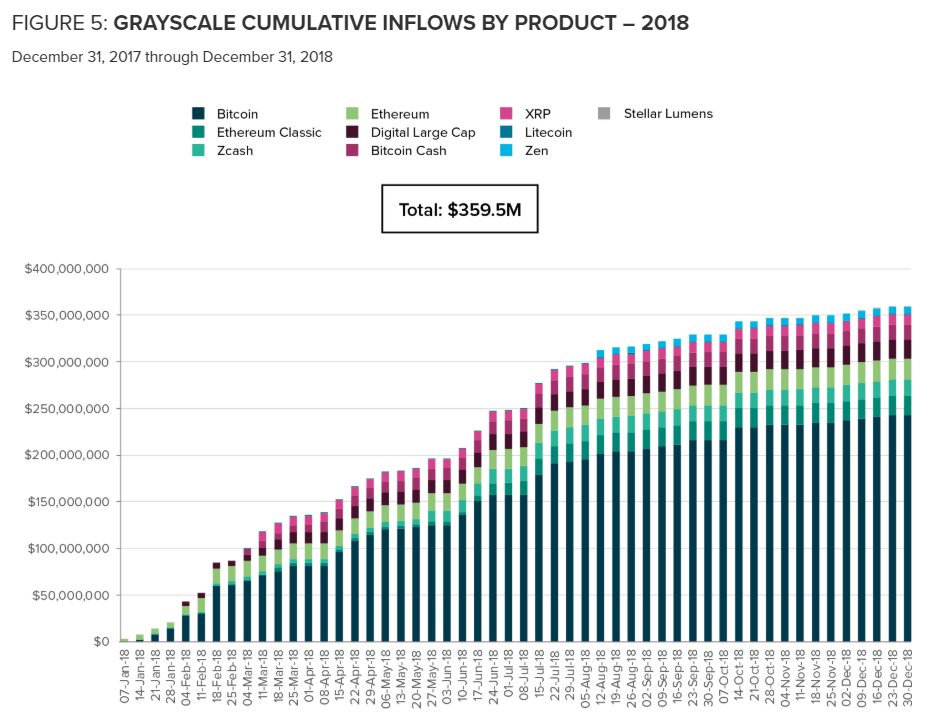

Writing in daily market commentary, eToro Senior Analyst Mati Greenspan drew attention to an interesting data point from Grayscale’s 2018 report, which the cryptocurrency investment firm published on Thursday.

Specifically, Greenspan noted that the vast majority of Grayscale’s $359.5 million in 2018 inflows piled into Bitcoin rather than the bevy of other cryptocurrencies now available through the firm’s product lineup.

Overall, bitcoin retains a 52.7 percent share of the cryptocurrency market cap. However, a staggering 88 percent of all new money entering Grayscale goes to the Bitcoin Investment Trust (OTC:GBTC), which invests directly – and exclusively – in the flagship cryptocurrency.

Given its high investment minimums, Grayscale’s client base is somewhat different than the cryptocurrency market as a whole, which is still dominated by retail buyers. According to the report, 66 percent of all new money came from institutional investors.

Could this be a preview of the direction the cryptocurrency market will take when more institutional investors begin coming on board, or will they end up wading deeper into the altcoin markets as well?

Time will tell, but if Galaxy Digital founder Mike Novogratz is right, we might find out soon.

Original story by: https://www.ccn.com/dow-futures-us-stock-market-bitcoin-price-teeter