Bitcoin Price Continues Steady Climb, Up 56% From Feb. Lows

Story by: Rakesh Sharma

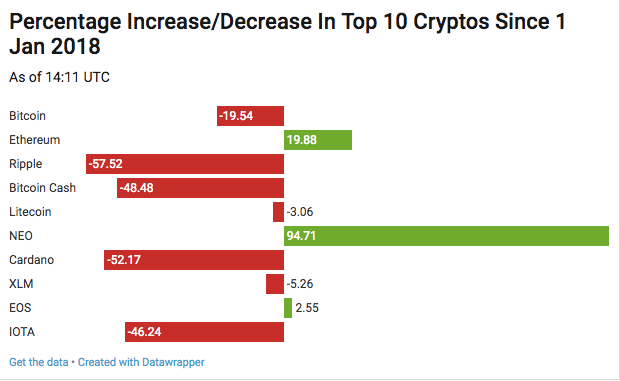

Bitcoin’s price continued its steady ascent in the last 24 hours. At 14:11 UTC today, it was trading for $10,791.98 per pop, up 4.64% from its price at the same time a day ago. That figure also represents an increase of 56% from its low of $6914.24 on Feb. 5.

Among the top 10 most valuable cryptocurrencies, bitcoin cash witnessed an uptick of 4.6% in the last 24 hours on the back of rising trading volumes. According to Coindesk, trading in the cryptocurrency surged by 38% in the last 24 hours. At 14:16 UTC, bitcoin cash’s price was $1293.12, up by 4.5% from 24 hours earlier.

Cardano was the other big mover in cryptocurrencies, rising by almost 7% from its price 24 hours ago. Those gains did not translate into much of a boost for cryptocurrency markets. At 14:23 UTC, the overall market cap for cryptocurrencies was $463.2 billion, up roughly 3.4% from its price 24 hours ago. It is still down by 10.6% from its high of $518.4 billion on Feb. 17th.

Ethereum In The Spotlight

The co-founder of ethereum, a cryptocurrency which has bucked the overall downward slide of cryptocurrency markets, was on CNBC to discuss the relationship between ether, the cryptocurrency, and ethereum’s public blockchain.

“We consider (ether) a cryptofuel because you need to pay small slices of ether every time you run a program or store information on public ethereum,” said Joseph Lubin.

According to him, the cryptocurrency’s performance on exchanges is a “referendum” on the underlying platform’s success because demand from investors drives the token’s price. As of last year, the jump in ether’s price has also reportedly made Ethereum foundation the richest blockchain organization among cryptocurrencies. Lubin himself is counted among the richest people in cryptocurrencies.

[Confused about the differences between Bitcoin, Ethereum and other cryptocurrencies? Learn cryptocurrency through Investopedia Academy’s Cryptocurrency for Beginners course. The course teaches you everything from blockchain basics to what it means to mine currency.]

He is also the CEO of ConsenSys, a Brooklyn-based firm that provides consulting and development services to corporations and governments to implement smart contract platforms. In the blockchain industry, Lubin sees a dynamic similar to the mid 1990s, when large corporations developed their private intranets (instead of using the public Internet). “We are seeing them getting their toes a little bit wet in a private, provisional context,” he said.

Correlation Between Bitcoin Price And Equity Markets

Research firm Datatrek came out with an update to its earlier missive on the correlations between bitcoin price and equity markets. (See also: Are Bitcoin Price And Equity Markets Correlated?) They measured 10-day historical correlations between bitcoin and the S&P 500 and found that bitcoin prices track the S&P 500 during downward slides in both markets. That correlation thins out during euphoria.

The analysts at Datatrek ascribe this changing dynamic to risk tolerance. As risk tolerance decreases, investors pull out money from all asset classes. “The same thing happened with gold during the Financial crisis, when the yellow metal was down in 2008 along with everything else,” they write.

Interestingly enough, Bloomberg came up with a similar but opposite conclusion on the topic of bitcoin price’s correlation with other cryptocurrencies. That is, bitcoin’s price moved in tandem with other cryptocurrencies during periods of high prices but lost that relationship during declines. Again, the ostensible reason driving the correlations is risk tolerance by investors.

Regulation News

China is furthering its crackdown on virtual currencies by investigating bank and online-payment accounts of individuals and organizations involved in cryptocurrency trading on overseas exchanges.

In response to the ban on cryptocurrency exchanges last year, Chinese exchanges transferred operations overseas or to Hong Kong. This has helped Chinese investors to continue cryptocurrency trading. A Bloomberg report quotes unnamed sources as saying that such account owners “could have their assets frozen or be blocked from the domestic financial system.”

Since the beginning of 2017, Chinese authorities have intensified their crackdown on cryptocurrencies. But their actions don’t seem to have had much effect. A glance through the top-traded exchange listings displays several Chinese exchanges, which have either begun catering to overseas customers or moved base to Hong Kong. Along with South Korea, the country is said to be a prominent player in setting cryptocurrency prices.

Israel is taking the opposite tack to China. The Supreme Court there has issued a temporary injunction to banks from prohibiting crypto accounts. The injunction was issued in response to Leumi Bank’s decision to prohibit a bitcoin exchange from operating an account because it flouted Israel’s Anti-Money Laundering (AML) regulation.

Investing in cryptocurrencies and other Initial Coin Offerings (“ICOs”) is highly risky and speculative, and this article is not a recommendation by Investopedia or the writer to invest in cryptocurrencies or other ICOs. Since each individual’s situation is unique, a qualified professional should always be consulted before making any financial decisions. Investopedia makes no representations or warranties as to the accuracy or timeliness of the information contained herein. As of the date this article was written, the author owns small amounts of bitcoin.

Original story: https://www.investopedia.com/news/bitcoin-price-continues-steady-climb-56-feb-lows/