Bitcoin Price and Cryptocurrency Markets Shed Gains

Story by: Rakesh Sharma

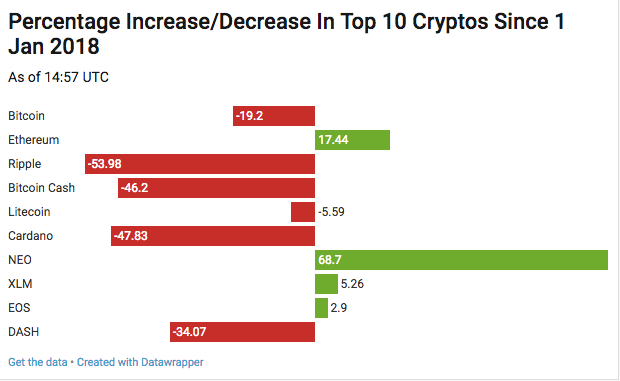

After crossing the $11,000 mark two days ago, bitcoin’s price reversed trajectory this morning. At 13:43 UTC, the price of a single bitcoin was $10,909.23, a decline of 2.98% from its price 24 hours ago. Earlier this morning, it was trading at $10,770.80.

There were no clear triggers for the fall in bitcoin’s price. Other cryptocurrencies followed bitcoin’s lead and were in the red, as of this writing. Their trading volumes fell and bitcoin’s rose to account for 40% of all cryptocurrency trading across exchanges.

Bitcoin cash, a cryptocurrency whose low transaction fees were briefly surpassed by bitcoin, was the biggest loser. At 13:53 UTC, it was trading at $1,404.95, a decline of 8.06% from its price 24 hours ago.

Litecoin was another loser. Its price surged by almost 14% within a couple of hours Tuesday morning after the crypto’s blockchain underwent a hard fork. (See also: Litecoin Price Spikes By 32% After LitePay News). But this Wednesday morning is different: Litecoin’s price has shed all of its gains. At 14:00 UTC, the price of a single litecoin is $221.98, a decline of 9.32% from its price 24 hours ago.

The overall market capitalization for cryptocurrencies is $475.3 billion, as of this writing. That figure is a decline of 7% in the last 24 hours.

Here is a brief look at some developments that may affect/have affected bitcoin’s price.

Coinbase and Bitfinex Implement SegWit

Two major cryptocurrency exchanges have announced that they have implemented SegWit for transactions.

North America’s largest cryptocurrency exchange, Coinbase, tweeted yesterday that it would begin rolling out SegWit this week. All its customers will have access to SegWit transactions by the middle of next week. (See also: Coinbase To Integrate SegWit: What It Means For You.)

Bitfinex, which is the world’s 4th largest exchange by trading volume, has also implemented the feature. “By supporting SegWit addresses, Bitfinex is tackling three of the biggest crypto-enthusiast concerns: transaction fees, transaction speed, and total network capacity,” stated Paolo Ardoino, Bitfinex CTO.

SegWit speeds up transaction speeds and decongests bitcoin’s network by increasing block size. In turn, this is expected to lower transaction fees and help bitcoin gain traction. Ardoino said implementation of SegWit will result in transaction fees that are as much as 20 percent lower.

Regulation News

Japanese cryptocurrency exchanges have come together to form a new self-regulatory organization after the recent Coincheck hack. Previously, the exchanges were members of the Japanese Blockchain Association and Japan Cryptocurrency Business Association. Both organizations set their own rules and were not overseen by the Financial Services Authority (FSA), which is responsible for overall regulation within the industry. The new body will only admit exchanges approved by the FSA as members. (See also: Should Cryptocurrency Exchanges Self-Regulate?)

Meanwhile, the U.S. state of Wyoming has approved two bills to encourage blockchain and cryptocurrency businesses in the state. And the Israeli Tax Authority has released a circular stating that cryptocurrencies will be treated as property for taxation purposes. Their stance is similar to that of the Internal Revenue Service, which has a similar definition for coins.

Dark Pools For Cryptos?

According to a WSJ report, Republic Protocol, a Singapore-based company, has raised $33.3 million for dark pool trading in cryptocurrencies, away from exchanges.

According to Taiyan Zhang, the company’s 21-year-old founder, the pool will boost cryptocurrency trading volume and capture $9 billion worth of crypto trading monthly. That target means it should not have a significant effect on cryptocurrency prices. The trading volume for bitcoin itself on a single day is $11 billion, as of this writing. (See also: An Introduction To Dark Pool Trading.)

Investing in cryptocurrencies and other Initial Coin Offerings (“ICOs”) is highly risky and speculative, and this article is not a recommendation by Investopedia or the writer to invest in cryptocurrencies or other ICOs. Since each individual’s situation is unique, a qualified professional should always be consulted before making any financial decisions. Investopedia makes no representations or warranties as to the accuracy or timeliness of the information contained herein. As of the date this article was written, the author owns small amounts of bitcoin.

Original story: https://www.investopedia.com/news/bitcoin-price-and-crypto-markets-shed-gains/