Bitcoin Funds Had Surprise Inflows as Markets Plunged

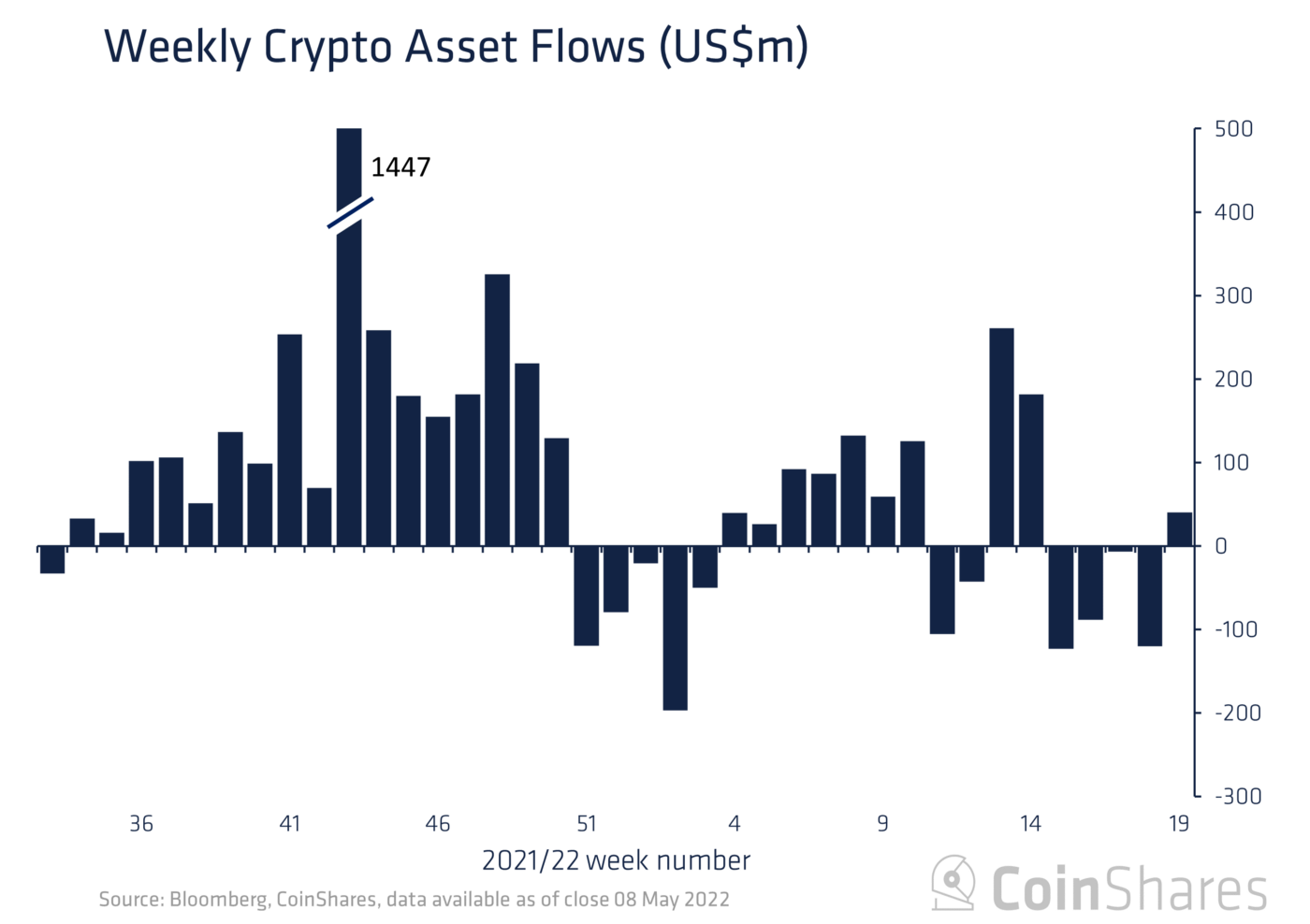

Digital-asset funds had $40 million in net inflows in the seven days through May 9. (CoinShares)

There was a surprising amount of inflows to digital-asset funds, the first time money came into the funds in four weeks. This came despite a plunge in prices for bitcoin (BTC) and most other cryptocurrencies.

Bitcoin funds racked up $45 million in inflows, CoinShares reported Monday. Because of outflows from funds targeting other cryptocurrencies, there was a net $40.3 million in inflows overall across all digital-asset funds.

The week’s inflows marked a sharp turn after four consecutive weeks of outflows.

James Butterfill, head of research at CoinShares, said the positive balance was likely due to “investors taking advantage of the substantive price weakness.” He questioned how durable the trend reversal might prove.

“Interestingly, we have not seen the same spike in investment-product trading activity, as we typically see historically during extreme price weakness periods,” Butterfill said. “It is too early to tell if this marks the end of the four-week run of negative sentiment.”

The price of bitcoin, the largest cryptocurrency by market capitalization, slid to $35,000 by Friday after opening the week at around $38,000. The price briefly spiked to $40,000 after the U.S. Federal Reserve hiked rates by 0.5 percentage point last week.

Most crypto funds trade on weekdays, when stock markets are open.

Bitcoin short funds, which profit off the BTC price falling, recorded their second-strongest inflows of the year, $4 million, reaching $45 million assets under management.

Funds focused on ether (ETH) extended their losing streak, seeing $12.5 million in outflows, bringing year-to-date outflows to $217 million.

Multi-asset funds recorded inflows of $1.7 million, totaling $150 million.

Solana’s SOL was the only altcoin seeing substantial inflows into funds, at $1.9 million, bringing its year-to-date inflows to $107 million.

Fund flows were lopsided by geography, as North American investment products saw inflows of $66 million while European funds saw outflows totaling $26 million.

Funds managed by Purpose and ProShare recorded inflows of $58.8 million and $19.3 million, respectively, while CoinShares XBT funds took a $18.4 hit, totaling $305 million in outflows since the start of the year.

Bitcoin funds saw $45 million in inflows in the first week of May, as ether-focused funds extended their losing streak. (CoinShares)

Via: Coindesk