Artificial Scarcity of Bitcoin Won’t Justify Its High Price

By ADAM LASHINSKY

This article first appeared in Data Sheet, Fortune’s daily newsletter on the top tech news. Sign up here.

Will there ever be peace in the Middle East? How many days can I honor my New Year’s resolutions? Is Bitcoin’s rise more than an ephemeral rush?

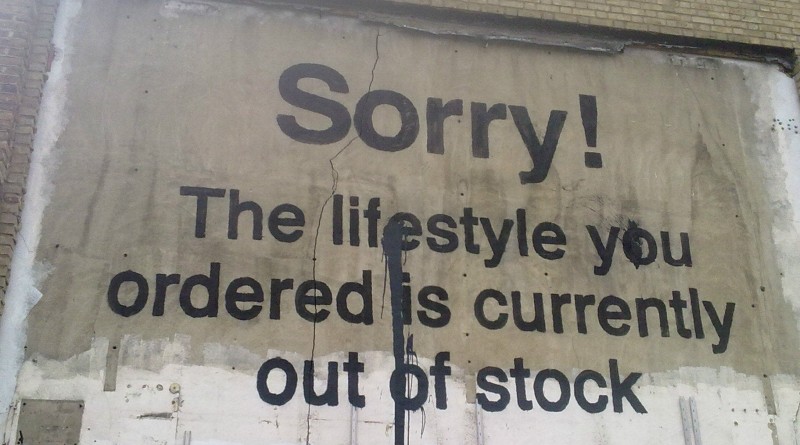

These are the existential questions of our age. I took the last one directly from a fine cover story in the new issue of Fortune by Jen Wieczner and Robert Hackett. They go deep and long on the most important topic to grip financial markets in a decade. So-called cryptocurrencies have captured the popular imagination despite having no intrinsic value, being opaque to the point of misleading, and demonstrating the kind of price volatility more common to penny stocks on a two-bit exchange.

A nagging concern I have about Bitcoin is the tautological argument used to support it. Bitcoin isn’t like anything else, so it can’t be compared to anything else. You can’t say exactly what it’s good for—surely a currency this volatile isn’t good for stored value—but it’s really good at being itself. Wieczner and Hackett liken this to scientists’ inability in the 18th century to characterize a platypus, which has the characteristics of several animal categories.

Another exciting if concerning thought: The preponderance of experts Wieczner and Hackett quote in their voluminous and detailed report are unknowns working for unknown firms. This is to be expected. A field this new must develop its own authorities.

It’s hard to say where all this is headed. Just because everyone wants to buy something doesn’t make it worthwhile to own. And artificial scarcity—which Bitcoin enjoys—is no justification for sustained high value. Still, where’s there’s smoke there’s generally fire. Too bad too many mindless investors will also get burned.

***

The incomparable Ben Thompson of Stratechery posted his year-end round-up of his greatest hits for 2017. (Have you noticed that some athletes sprint through the tape? I feel like I limp to the finish line.) Two of his top five posts for the year had to do with Amazon (AMZN, -0.30%) and one each was about Microsoft (MSFT, -0.02%), Facebook (FB, -0.26%), and Uber. Sounds about right.