The Week Bitcoin Went All Tabloid.

By

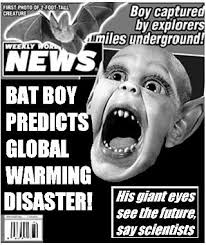

Reading bitcoin headlines this week felt a bit like checking out at the grocery store back in the 1990s, when impulse buys not only included Airheads and Nerds Rope candy, but a salacious selection of tabloid newspapers like the Weekly World News and the National Enquirer.

Instead of tales of “bat boy” and Dick Cheney being a robot, we learned of an alleged attempt to buy Kanye West’s latest album, a settlement being reached between one of bitcoin’s former stars and the FTC (which they reportedly can’t afford to pay), and a Hollywood hospital coughing up $17,000 in bitcoin to get its computers back. Along with some pretty interesting — though certainly less dramatic — business developments.

An image with Martin Shkreli’s name in the top-left corner tweeted by Gabe Bedrosian. On Valentine’s Day weekend Shkreli used Twitter to claim he was negotiating to purchase rights to Kanye West’s new album before later saying he’d lost 15 million worth of bitcoins.

Enlarge.

Imposter Kanye West posse member dupes “Pharma Bro”: If I were saying this, I’d have to take a deep breath before I started. Here goes: The former CEO of Turing Pharmaceuticals, Martin Shkreli, who first rose to fame for hiking the price of a drug used to treat AIDS, then purchased the only copy of Wu-Tang Clan’s latest album for $2 million, wrote in a stream of Tweets on Tuesday that he’d been swindled out of $15 million worth of bitcoin by someone he thought represented Kanye West, to acquire the exclusive rights to his newest album, “The Life of Pablo.” In a video chat following the Twitter posts, Shkreli seems to have left his credit card information exposed, resulting in what appears to be an order on his behalf by someone else who was sending him a 55-gallon-drum of lubrication. Exhale.

Angel wings for Butterfly Labs?: The Leawood, Kansas-based bitcoin mining company, Butterfly Labs, which rose to fame with the price of bitcoin two and a half years ago, this week settled with the FTC for $38.6 million for what a federal judge once said had the “strong smell” of fraud, according to an Ars Technica report. The company, which promised to sell super-fast, custom-built computers made just for mining bitcoin, once accepted pre-orders for $4,000 but then delayed delivery of the product — or never delivered it — as the price of bitcoin crashed and purchasers saw their investment quickly decline in value. The actual settlement has already been suspended, pending the company’s agreement to pay a $15,000 amount, along with some personal payments due from other individuals.

California hospital prescribes bitcoin ransom: After almost two weeks of being locked out of its computers by hackers, the Hollywood Presbyterian Medical Center this week decided to pay a 40 bitcoin ransom, at the time worth about $17,000, to return its operations to normal, according to a Forbes report. The case highlights a global epidemic of ransomware, software that locks computers behind an encrypted wall unless their owners pay a fee and bitcoin has become the payment-method of choice for hackers. According to the report, Russian ransomware Locky infects at least 90,000 machines a day.

IBM goes all-in on blockchain: Not all the news around bitcoin and its related ledger technology, called a blockchain was quite so tabloidy. Also this week, Armonk, New York-based IBM made a series of announcements about its own blockchain work, including integration of blockchain services with its Watson artificial intelligence, partnerships with two separate global stock exchanges and the launch of blockchain “garages” in New York and elsewhere, we reported on Tuesday.

Dwolla is back in the blockchain: Des Moines, Iowa-based Dwolla, a payment processing network that was one of the earliest supporters of bitcoin, has once again embraced the blockchain after more than a two-year break. In October 2013 Dwolla stopped transacting in bitcoin just as drama around the cryptocurrency was reaching a peak. Today, CoinDesk reported that Dwolla is now working to stand as a gateway between cryptocurrency transactions and fiat transactions in businesses.

Tech geek’s delight of the week: Pointing out vulnerabilities in the way bitcoin is created, or mined, hasn’t historically been a way to become popular in some corners of the bitcoin community. But that didn’t stop Rakesh Kumar, over at the EE Times, from sharing a way he says Application Specific Integrated Circuit (ASIC) miners can “maximize profits” by playing on the network’s tolerance to faults. Read the details here. In 2013, Cornell University researchers Ittay Eyal and Emin Gun Sirer published a paper on how someone might trick the network into gaining 51 percent majority control over the mining power. Initially viewed by some “bitcoiners” as a treacherous act for showing ne’er-do-wells how to undermine the network, the paper has since been widely viewed as valuable by opening a discussion about how to make the network more robust.

Bitcoins, in dollars and cents: The price of bitcoin increased 10 percent this week, from $380 a week ago, to $418 at the time of publication today.

via: http://www.bizjournals.com/newyork/news/2016/02/19/the-week-bitcoin-went-all-tabloid.html