This Key Data Point Shows Bitcoin Took A Huge Step Forward In 2019

Story by: Kyle Torpey

2019 was a great year for Bitcoin based on a variety of different metrics, including the one that most people are more concerned about than any other: the price. Last year’s bull run has already led to many 2020 Bitcoin price predictions, ranging from $20,000 to $50,000.

However, there is one overlooked data point that sums up Bitcoin’s tremendous 2019 better than any other.

Many cryptocurrency pundits have pointed out that the Bitcoin price responded to the recently increased tensions between the United States and Iran in a manner similar to gold; however, despite all of the comparisons, the reality is that there isn’t much of a correlation between these two assets at all.

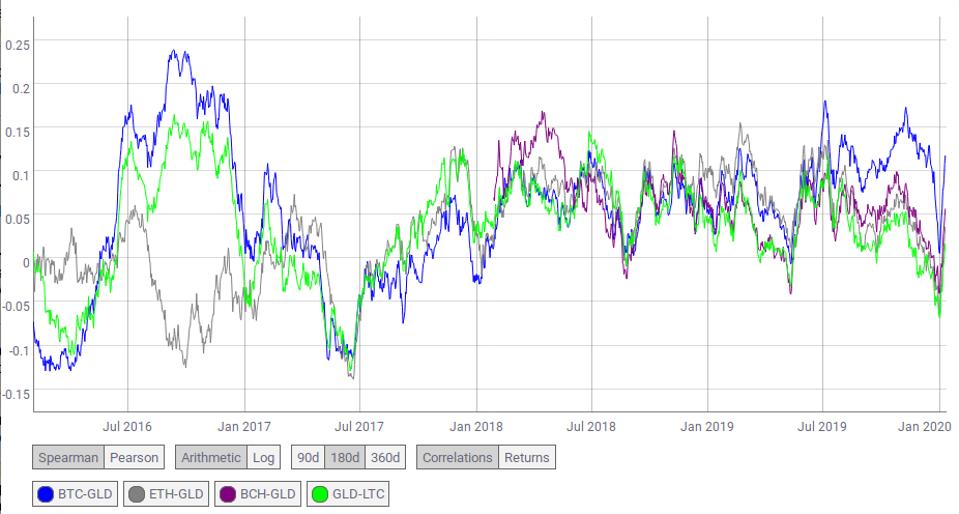

Having said that, Bitcoin became more correlated to gold than all of the major altcoins in the second half of 2019, which indicates that the “digital gold” term may be becoming much more than just a meme.

Bitcoin Separates Itself from the Pack

While Bitcoin has been referred to as digital gold for a number of years, 2019 was the year when this analogy really started to take hold. Bitcoin was a topic of conversation around the developing trade war between the United States and China, the use of Bitcoin as an inflation hedge gained greater notoriety, and the ultimate bull case for Bitcoin as a true digital gold gained steam.

Even members of the United States Congress began to describe Bitcoin as an enormously valuable asset that could eventually threaten the U.S. dollar’s global reserve currency status.

PROMOTED

The specific reasoning behind the increased understanding of Bitcoin’s role in the financial world is difficult to pin down; although, it’s possible Facebook’s Libra project led to an awakening. This was certainly the case for CNBC’s Joe Kernen.

The above chart showers the historical correlations of Bitcoin, Ether, Bitcoin Cash, and Litecoin to … [+]

COIN METRICS

As the above chart from Coin Metrics shows, Bitcoin separated itself from the rest of the cryptocurrency market in terms of a closer correlation with gold in the second half of 2019. Bitcoin’s 180-day Spearman correlation coefficient was over 0.1 for much of December, while the coefficients for Ethereum, Bitcoin Cash, and Litecoin were all below 0.05. On a related note, the altcoin market more generally has severely struggled against Bitcoin over the past couple of years.

While Bitcoin still has plenty of work to do in terms of competing with gold as a global, apolitical store of value, the crypto asset took a major step forward in 2019. Bitcoin’s relative correlation to gold compared with other crypto assets should be a trend to watch throughout 2020.

Original story: https://tinyurl.com/qszjfnd