The 5 Reasons Why Bitcoin Will Reach $20,000 Again, And Soon-ish

Story by: Thomas Hughes

The cryptocurrency market has awakened after a long sleep.

Bitcoin’s price is up 80% since the December low. How high can it go?

There are five fundamental factors driving Bitcoin’s price increase.

You can expect to see Bitcoin retest its all-time highs and sooner than you may think.

The cryptocurrency market has awakened after a long hibernation. The price of Bitcoin (BTC-USD), the world’s reserve cryptocurrency, is up a whopping 85% since hitting its December 2018 lows and it looks like more gains are on the way.

The question, of course, is how high can Bitcoin’s price go? The crypto coin is far from the decentralized solution to payments promised by its creators and it hasn’t attained mass adoption.

Believe it or not, there is a bull case for Bitcoin and cryptocurrency that comes down to one thing; blockchain technology has utility and where there is utility there is are opportunities.

#1 – Bitcoin, The Gateway Crytpocurrency

As trite as it sounds Bitcoin is a gateway to cryptocurrency. Bitcoin is the most well-known cryptocurrency on the planet. You can’t get away from it, Bitcoin dominates media headlines and is often a blanket representative for the entire cryptocurrency market.

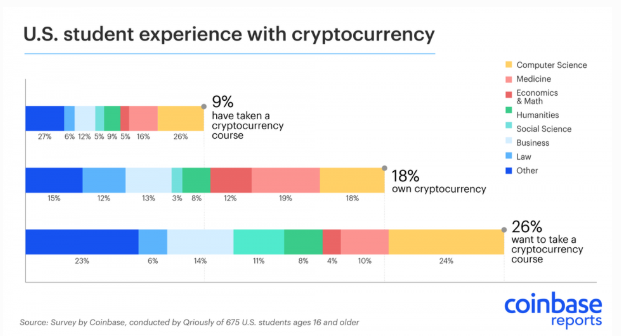

Studies by YouGov.Omnibus released late last year reveals Americans’ awareness of Bitcoin has reached 80%. Bitcoin led with an awareness percentage of 71%. The next closest contender was Ethereum (ETH-USD) at only 13%. Another study, of U.S. college students, shows 18% have owned or own Bitcoin and 26% would like to take a course about crytpocurrency. Notably, the mix of degree seekers was well diversified.

There is no guarantee Americans will begin to use Bitcoin or even cryptocurrencies, but these figures suggest the opposite. Bitcoin, blockchain, and cryptocurrencies have utility and awareness is spreading.

There is no guarantee Americans will begin to use Bitcoin or even cryptocurrencies, but these figures suggest the opposite. Bitcoin, blockchain, and cryptocurrencies have utility and awareness is spreading.

#2 – Bitcoin Is The Most Stable Cryptocurrency

I do not want to imply that Bitcoin’s price is stable because it isn’t. Bitcoin’s price is still wildly volatile but volatility has been on the decline. Along with that BTC’s hash rate and market-dominance have both stabilized and at what I will call satisfactory levels.

Volatility – A look at the weekly chart, using Bollinger Bands (A commonly used measure of volatility) will show the narrowest bands in nearly two years occurred last month. Last month, MarketWatch reported Bitcoin experienced its 2nd lowest volatility month on record, a mere 7.8%, but noteworthy for one reason; Bitcoin typically experiences a low in volatility just before it begins each bull run.

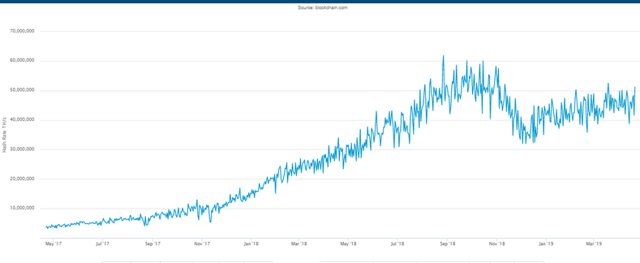

The Hash Rate – The Bitcoin Hash Rate is a measure of how much computing power is being used on the Bitcoin network. After hitting a peak in late 2018 the hash rate plunged along with the broader cryptocurrency market. The hash rate fell because miners were no longer making the easy money, effectively shaking out the weak positions, and there were other opportunities with different blockchains. The hash rate has since stabilized near the 2018 all-time highs and is evidence of continued support among the network. Forks of Bitcoin like Bitcoin Gold, Bitcion SV, and even Bitcoin Cash (all intended to improve on the original) have not garnered the same consensus.

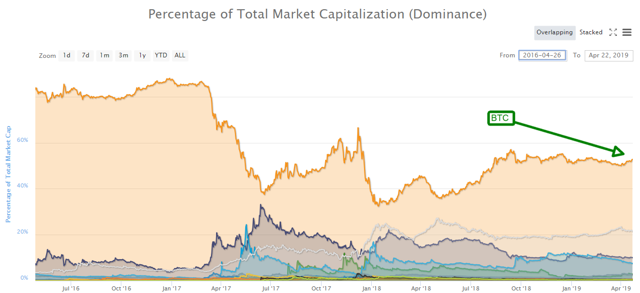

Bitcoin Dominance – Bitcoin’s dominance is a measure of its value relative to the broad cryptocurrency market. At one time it was the only cryptocurrency, 100%, but things have changed since then. Starting in early 2017 the market was flooded with new cryptocoins and tokens that stole market share from Bitcoin. Many of those coins and tokens have gone extinct, others have lost their luster, and BTC has emerged victorious. Bitcoin’s dominance has stabilized above 50% with the number two Ethereum at only 10%.

#3 – The Infrastructure Is Growing

The infrastructure for Bitcoin is growing. Not only is the Bitcoin development team and community constantly working toward improving the network other projects are ongoing as well. The irony is that many of the solutions to widespread Bitcoin use lay in other blockchains. Technologies like OmiseGo (OMG-USD) and Ripple (XRP-USD) are built on alien networks yet enable cross-border atomic swaps of cryptocurrencies and fiat money.

Just today Moon, a cryptocurrency payment processing start-up, announced it had made it possible to purchase directly from Amazon using Bitcoin. To be clear, Amazon (AMZN) does not directly accept Bitcoin; Moon facilitates the exchange of currency/cryptocurrency and purchase of items. The company expects to be connected to virtually all online merchants within two years.

#4 – Institutional Interest

There is institutional interest even if Bitcoin is still little more than a fringe investment. One sign of this is Bakkt. Long in coming, Bakkt is a joint venture of the ICE to create and launch a full-service exchange, wallet, trading platform, and settlement agency. It would be CFTC/SEC regulated cryptocurrency infrastructure.

The platform’s launch has been delayed twice due to regulatory issues but, once solved, will provide CFTC regulated access to cryptocurrency trading and physically settled Bitcoin futures trading.

Even with Baakt futures trading of Bitcoin is still going strong at the CME and there are others waiting in the wings. The SEC Commissioner has said a BTC ETF is inevitable and there are a half dozen applications in-process including those from Van Eck, Bitwise, and the Winklevoss twins.

Bitcoin bulls like Tom Lee still have faith in the technology and see price gains on the horizon. Lee says his firm Fundstrat’s Bitcoin Misery Indicator is signaling the start of a bull market. According to him, there may be some near-term headwind as current BTC holders move into Altcoins but the longer-term picture is bullish.

#5 – Scarcity

Bitcoin is scarce and getting scarcer. To begin with, there are only going to be 21 million Bitcoins ever. There is no central bank to issue new BTCs, there is no way to print more, that will be it. In terms of mining and the available supply there are about 17.67 million BTC on the market right now. That’s nearly 85% so not much left to mine.

Of those that have been found, there are an estimated 4.2 million to +6 million BTCs that are lost or irrecoverable. Lost or irrecoverable means they are listed on the blockchain, we know where they are relative to the network, but the wallets that hold them are unused or unusable. An unused wallet is one someone forgot about and has access to, an irrecoverable or unusable wallet is one that is known but access is impossible because keys or passwords are lost.

Believe it or not, some people are losing Bitcoins on purpose. The practice is called Burning, Coin Burns, or Proof of Burn and is used to transfer value from one blockchain to another.

The basics of a coin burn are this; if I wanted to create 1,000 tokens of ThomasCoin that are worth $1 each at initiation I could burn $1,000 worth of Bitcoin. The act of burning is to publicly and irretrievably send the $1,000 of BTC to a known wallet whose access keys have been encrypted and erased. The BTC still exist but are forever lost to the market and become the basis of value for the new ThomasCoin.

*The Halving, also Halvening – Bitcoin is going to undergo a halving of its mining reward in just over a year. The halving is part of the core Bitcoin code and meant to ensure mining can be sustained for the longest possible amount of time. What the halving does is decrease the block reward by half, from the current 12.5 to 6.25, and tighten the market.

The Forecast Is Bullish

Bottom line, there are, assuming no more BTCs will be lost, at best about 15 million BTCs for the entire market to share. 15 million. At the end of last year, there were about 32 million Bitcoin wallets. 32 million is equal to less than 0.50% of the total world population. This means that less than 0.50% of the world owns 100% of available BTC. It will not take much of an increase in demand to put significant upward pressure on Bitcoin prices.

Now that BTC/USD is moving up from the $5,100 level the next target for resistance is $5,800. A move above $5,800 will probably go to $8,000 and, if that happens, I expect to start seeing increased media coverage and a little FOMO buying. Longer-term, the target is $20,000. The market has already proven that is how it can go, once that level is surpassed calls for BTC $50,000 and $100,000 won’t be far-fetched.

Original story: https://seekingalpha.com/article/4256234-5-reasons-bitcoin-will-reach-20000-soon-ish