Launch of bitcoin futures dragged down prices, Fed paper shows

Story by: Kate Rooney

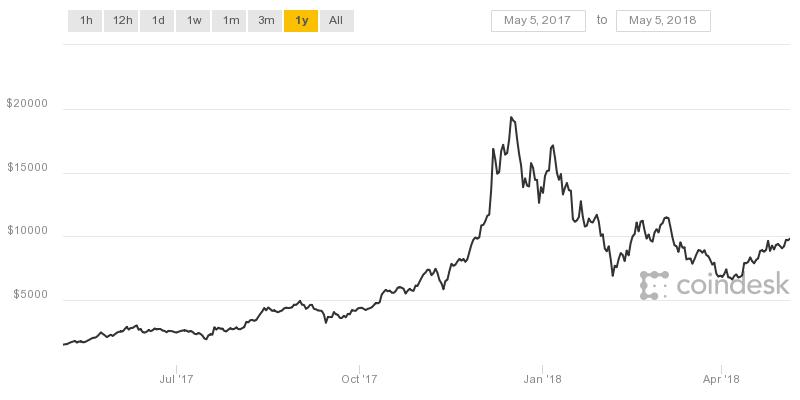

Bitcoin’s decline following a climb to nearly $20,000 was directly tied to the launch of a futures market, according to research from the San Francisco Federal Reserve published

Monday.

“The rapid run-up and subsequent fall in the price after the introduction of futures does not appear to be a coincidence,” four researchers wrote in the regional Fed bank’s most recent Economic Letter. “It is consistent with trading behavior that typically accompanies the introduction of futures markets for an asset.”

Peak bitcoin prices lined up with the day the Chicago Mercantile Exchange, or CME, introduced bitcoin futures trading on Dec. 17. That same day, bitcoin hit a high of $19,783, according to data from CoinDesk. The Chicago Board Options exchange, or CBOE, also opened a futures market a week earlier but trading there was thin, the letter said.

Bitcoin’s 12-month performance

Source: CoinDesk

Until futures existed it was extremely difficult, if not impossible, to bet on the decline of bitcoin prices, the researchers said. As optimistic investors continued to bid up, the cryptocurrency rose more than 1,300 percent in 2017.

The pessimists meanwhile, had no financial way to back a belief that the bitcoin price would collapse.

“So they were left to wait for their ‘I told you so’ moment,” the researchers said. “The launch of bitcoin futures allowed pessimists to enter the market, which contributed to the reversal of the bitcoin price dynamics.”

As of Monday, bitcoin was trading at about half of its pre-futures peak, near $9,365 as of 3:10 p.m. ET, according to CoinDesk.

The researchers compared this price reaction to mortgage-backed securities, which they said hinged on the same driving force of optimistic and pessimistic traders.

As for why it was a gradual fall rather than an overnight collapse, researchers said it could be a lack of attention or willingness to enter the market on the first week of trading.

Future prices and demand could be helped by any traditional financial institutions becoming more willing to accept bitcoin, and official recognition and regulatory acceptance of bitcoin as a means of payments, they wrote.

But a competing cryptocurrency becoming more widely used could cause bitcoin to “drop precipitously because these tend to be winner-takes-all markets,” researchers said.

Original story: https://tinyurl.com/yctz3odx