Congressman Stephen Lynch Supports Sandbox-Like Crypto Pilots

By

When asked during a telephone interview how Acting Comptroller Brooks would balance the oversight of large federal banks with crypto alternatives, Lynch said “It’s just great. There are too many bankers and U.S. agency leaders that did not grow up with this stuff and are afraid of change, which is to our detriment.” Lynch had already asked his staff to reach out to Brooks’ team at the OCC to see what infrastructure would support the Acting Comptroller. “Maybe we can help get these financial markets to give this stuff a try,” said Lynch.

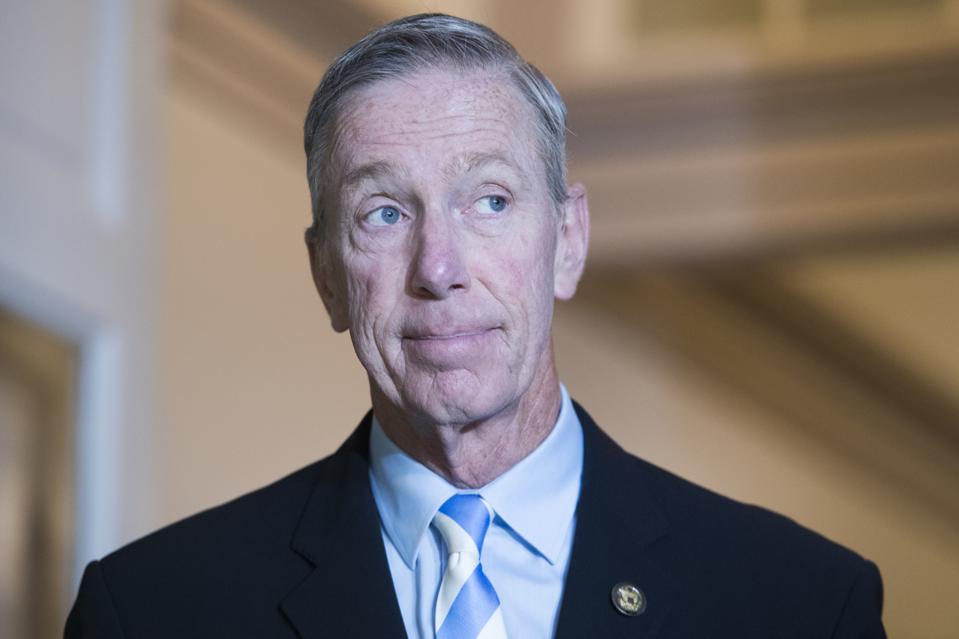

Congressman Stephen Lynch (D-MA), Chair of the FinTech Task Force (Photo By Tom William/CQ-Roll … [+]

CQ-Roll Call, Inc via Getty Images

“How do we start pilot programs in a ‘sandbox-like’ environment, that we then scale up to a full sandbox?” pondered Lynch. In looking at new payments charters and crypto and blockchain regulations, Chairman Lynch sees Brooks as someone who gets the need for market innovations and competitiveness in our financial markets with the rest of the world. Last week, Brooks launched an Advanced Notice of Public Rulemaking for crypto and blockchain matters to receive public input on possible crypto regulations, due August 2.

FinTech Task Force Faster Stimulus And FedAccounts Hearing

In the phone interview, Lynch also commented on a hearing today called, “Inclusive Banking During a Pandemic: Using FedAccounts and Digital Tools to Improve Delivery of Stimulus Payments.” Chairman Lynch said, “The unbanked is a segment of society where the gaps became evident with the rebate checks sent out,” as the direct deposits were sent out in a way that those most closely tied to the banking system received their COVID-19 payments first. The Chairman noted during the hearing that it had been 76 days since the CARES Act had been passed and there were still individuals who had not received their economic stimulus checks.

(L-R) Representative Stephen Lynch (D-MA) and Dr. Anthony Fauci (R), Director, National Institute of … [+]

AFP via Getty Images

“It was good to ‘run the traps with the experts’ on a couple of proposals,” said Lynch. Regarding the idea of ‘FedAccounts’ that would deliver stimulus payments in real-time from the Federal Reserve to individual bank accounts, Lynch was more skeptical. The Chairman noted how the ‘FedNow’ program at the Fed, looking to establish real-time payments between the Federal Reserve and the commercial banks, had taken three years to write the rule and that it was not expected to be completed for another 8 years.

Based on the experience of the Congressman, it struck him as unlikely that the Fed could do with individuals what it still had not done with its own banks it deals with on a daily basis already. According to Lynch, he appreciated the enthusiasm of two of the witnesses – both Mehrsa Baradaran, Professor of Law, University of California Irvine School of Law, and Morgan Ricks, Professor of Law, Vanderbilt University Law School – in that, according to both, they believed that if the U.S. prioritized the effort, FedAccounts could be established rapidly. Ricks had conceived of the idea of ‘FedAccounts’ for all accounts, arguing in the hearing that the Fed only provided accounts to an exclusive group and that the idea would be to broaden their mission to include all Americans as banking customers. Baradaran noted that she believed that it is part of the Fed’s mission “to provide equitable access and an adequate level of services nationwide.”

According to Lynch, the overall mission of the Fed and its ability to start providing banking services to the public, “…they are not built for this and Congress has not asked them to undertake this.” Lynch believes there is a wider policy debate that must be held and the request should be balanced against what Congress has already tasked the Fed with before providing new and different tasks to carry out.

‘Digital Dollar’ Discussion

Meanwhile, the Ranking Member of the Task Force, Congressman Tom Emmer (R-MN), noted the discussion of providing benefits in the hearing needed to co-exist with the idea of a digital dollar, which Emmer defined as a ‘U.S. central bank digital currency.’ Such a ‘digital dollar’ should emulate the physical form of a U.S. dollar by being tokenized as a bearer instrument, as opposed to an account-based program such as ‘FedAccounts.’ Witness J. Chris Giancarlo, Senior Counsel at Willkie Farr and Gallagher and former Chairman of the U.S. Commodity Futures Trading Commission (CFTC), echoed the sentiments of Emmer in explaining his view of a ‘digital dollar’ as something that captures the need for U.S. currency to remain the global reserve standard.

However, Ricks noted the ‘digital dollar’ as one that is already in existence, and the key is simply making these ‘digital dollars’, that are currently only used between the Fed on an exclusionary basis with commercial banks, open to the public. Giancarlo noted, “Part of the problem is the word ‘digital.’ We coined the phrase ‘digital dollar’ back in January. We thought it would catch people’s attention and had a nice a ring to it. Now it has confused things.”

Giancarlo has considered a digital dollar mission critical for the world and in the hearing compared the importance of it to both the space race and the development of the Internet. According to Giancarlo, he noted the FedAccounts introduced by Professor Ricks in the hearing was aimed specifically at the financial inclusion issue.

The Digital Dollar Project recently published its first white paper that was included by Giancarlo as part of the record of the hearing. “The Digital Dollar whitepaper from former CFTC Chairman Giancarlo has many interesting proposals including the idea of enabling a tokenised digital dollar that although distributed via commercial banks would allow the public to hold it in their own digital wallets, very similar to paper banknotes today,” stated Henri Arslanian, PwC Global Crypto Leader and a leading influencer on central bank digital currencies around the world.

David Treat, the Senior Managing Director, Co-Lead of Accenture’s Blockchain Business was asked if the Federal Reserve could develop retail bank account capabilities to address the current COVID-19 stimulus payments. “Large scale transformation is what we do. We have the innovation, expertise, and scale to drive ecosystem wide transformation. All of the suggested solutions that are being considered now will take time to implement; nothing could be done at that scale safely and effectively in a matter of days and weeks; it would take months and quarters,” stated Treat.

Giancarlo, who as the former CFTC Chair that pushed for moving the agency from an ‘analog’ to a ‘digital’ world of trading, agreed with the sentiments of Chairman Lynch who pointed out that Brian Brooks showing leadership in this area is terrific. Just as Giancarlo became known as ‘Crypto Dad’ based on the role he played in supporting crypto while at the CFTC, there are rumblings that describing Brooks as the new ‘Crypto Uncle’ based on his bullish views toward crypto and blockchain at the OCC.

“I commend Devron Brown, Senior Counsel of the Task Force on Financial Technology, for convening this hearing to continue this important conversation about how to digitize the dollar to more effectively deliver direct benefit payments to the unbanked and under-banked not only during times of crisis, but everyday. New technologies like blockchain offers solutions to address the many barriers Black, Brown, and rural communities face and can help to ensure greater equity in our financial system. The more options available to all Americans, the more inclusive money becomes,” said Cleve Mesidor, Founder of the National Policy Network of Women of Color in Blockchain.

One of the cryptocurrency exchanges, Binance.US, which could possibly participate in one of these pilot programs described by Lynch, has been outspoken on how stablecoins could be used to deliver stimulus benefits on cryptocurrency exchanges at a very low cost. Catherine Coley, CEO of Binance.US had to say, “Access to money changes lives. Crypto is pushing others in government and banking to reconsider existing systems. Without crypto pushing the envelope on decentralization, these conversations were never on the agenda.” Lynch mentioned the idea of a roundtable in the near future where a discussion could be held on how to move forward on pilots for the existing financial markets to experiment with crypto.

Via: Forbes