Bitcoin’s Newly Emerging Commercial Application Catalyst Could Power New Highs

Story by: Bull & Bear Trading

Bitcoin is up 12% since Friday and up more than 22% for the last week. This level of volatility continues to attract global institutional traders to this cryptocurrency market.

China’s blatant current currency manipulation of the yuan has provided the latest catalyst for Bitcoin’s most recent move higher.

Bitcoin has been consolidating 250% gains for 2019 on the chart. Trader’s Idea Flow believes the next move higher could test the December 2017 all-time high.

The newly emerging commercial application catalyst is “absorbing” a rapidly-growing percentage of the daily supply of Bitcoin. This catalyst could continue to gain momentum and drive Bitcoin to new all-time highs.

This idea was discussed in more depth with members of my private investing community, Trader’s Idea Flow. Start your free trial today »

Traders enter the week of 8/5/19 with news of China’s efforts to devalue the yuan. In an effort to mute the impact of tariffs, the Chinese are clearly involved in the manipulation of their currency. Bitcoin (BTD-USD) has been a beneficiary of trade tensions as the cryptocurrency continues its evolution as a globally acknowledged alternative asset class. Trader’s Idea Flow posted for our subscribers on Thursday that Bitcoin had interestingly responded similar to a safe haven trade as new tariffs were announced. We also published this July article on Seeking Alpha calling for a new high in Bitcoin by year end 2019.

Traders enter the week of 8/5/19 with news of China’s efforts to devalue the yuan. In an effort to mute the impact of tariffs, the Chinese are clearly involved in the manipulation of their currency. Bitcoin (BTD-USD) has been a beneficiary of trade tensions as the cryptocurrency continues its evolution as a globally acknowledged alternative asset class. Trader’s Idea Flow posted for our subscribers on Thursday that Bitcoin had interestingly responded similar to a safe haven trade as new tariffs were announced. We also published this July article on Seeking Alpha calling for a new high in Bitcoin by year end 2019.

As confirmed by recent trading moves correlated to global events, it’s fair to say that Bitcoin now represents a non-sovereign, digital store of value that responds to macro global developments. This is another major step forward in the continued evolution of this cryptocurrency asset class.

The following catalysts for Bitcoin’s move higher are by no means comprehensive, but they are prevalent at this time:

Trade Tensions Catalyst

A weaker yuan has been a concern among holders of the Chinese currency for some time. The Chinese government’s current action to devalue the yuan now becomes a catalyst for selling the yuan. The Chinese government has sought to stem outflows of capital away from China over the years. Bitcoin became an effective method of moving capital away from the reach of the Chinese government. While the Chinese government implemented capital controls / bans on cryptocurrencies, markets predictably found alternate routes to move their capital. Money always moves to where it’s being treated best so a variety of mechanisms have enabled holders of the yuan to trade Bitcoin “underground.” Oftentimes, this means that larger entities use offshore platforms to exchange yuan for Bitcoin, dollars, gold, etc.

There always have been steady outflows of capital from China to fund everything from global real estate to expensive tuition payments for U.S. and European colleges. Now the deleterious affects upon the Chinese economy from the trade tensions are accelerating capital outflows. Avoiding Chinese government capital controls seems to be rampant as a number of sellers in China seek to move their capital to safer havens. The recent devaluation of the yuan is another catalyst for capital flight out of China. The underground market in BTC for sellers of the yuan seems to be a viable pathway to move capital away from China. This capital flight seems to be finding safer havens that now include Bitcoin.

Institutional Investors Catalyst

Bitcoin during 2019 has been driven by a growing number of institutional investors. Increasing involvement of larger institutional investors globally is a much more accepted and acknowledged development today than in December 2017 when Bitcoin made its all-time high of nearly $20,000. Bitcoin observers believe that the current move higher that began during the first half of 2019 was largely institutional driven. This continued growth in the Bitcoin universe of investors is likely to continue as institutions recognize the emerging commercial applications of Bitcoin that continue to evolve and increase.

Commercial Application Catalyst

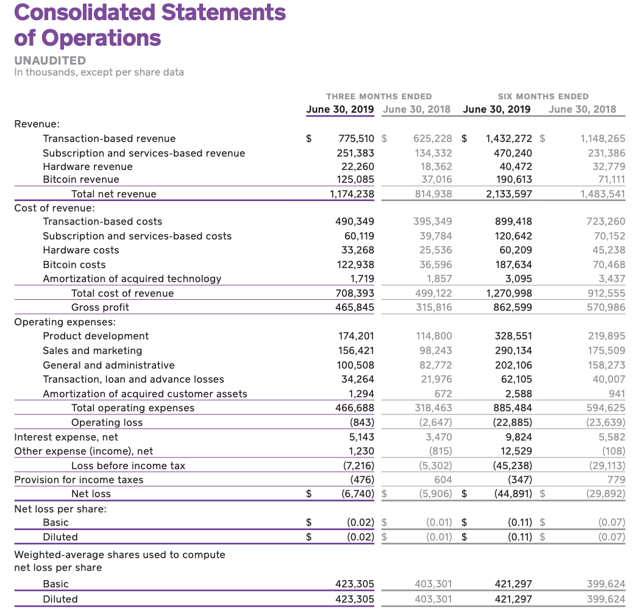

Jack Dorsey, founder of social media platform Twitter (NYSE:TWTR) and also payments processor Square (NYSE:SQ), is a raging Bitcoin bull. Dorsey believes that this cryptocurrency could become the global currency for the Internet. Here’s the possible catalyst for traders to consider: Square’s app, Square Cash, rolled out the ability for users to buy Bitcoin about 18 months ago. Revenues from Bitcoin based sales have ramped up rapidly to $125 million, which is up 100% quarter over quarter in 2019. This rate of growth turns heads across the commercial landscape. Others are likely to follow Square’s lead. Here’s the thing: it’s estimated that Square’s one app is now “absorbing” well over 10% of the daily supply being mined in Bitcoin. Let that sink in. As Square’s voracious appetite for the supply of Bitcoin continues to grow, then what happens as other commercial players follow the growth in revenues demonstrated by Square? The answer for this basic supply/demand question may be that a scarcity in the supply of Bitcoin emerges.

This commercial catalyst for the Bitcoin bull case is now rapidly becoming a driving force for higher prices. Now that Square is disclosing their tremendous success since rolling out their Bitcoin sales channel on their payments app Square Cash. This newer catalyst may be an undeniable force as Square Cash’s demand continues to surge higher. Inevitably, other commercial players will want to participate in the type of growth that Square is achieving with Bitcoin sales. This confluence of commercial factors may rapidly effect a scarcity of supply for Bitcoin. This developing commercial catalyst plays well with our previous calls for a new all-time high in this cryptocurrency before end of year 2019 and Bitcoin $50,000 in 2020.

Supply-Demand Catalyst

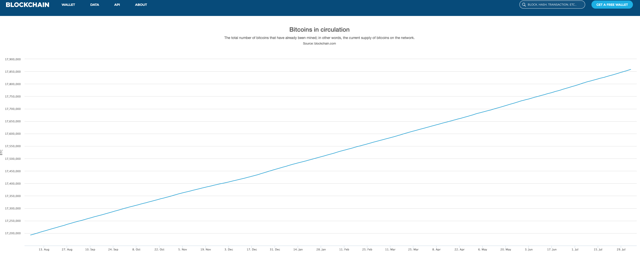

There’s debate about the amount of “lost Bitcoin” that reduces the already limited supply of this cryptocurrency that’s rapidly approaching. However, there’s great clarity that the supply of Bitcoin is only 21 million coins. The chart below illustrates that Bitcoin’s supply of nearly 17.9 million coins is approaching its supply limit of 21 million coins. The closer this limited number of coins moves toward its maximum supply, the more upside pressure in prices that traders might expect.

Summary

This latest news of increasing trade tensions are a continuing positive catalyst for the global, digital store of value known as Bitcoin. As Bitcoin has evolved into what appears to be a safe haven trade with the perception of digital gold, this asset has appreciated 22% in the last week alone.

Institutional investors globally have been acknowledging their increasing willingness to participate in the trading market for Bitcoin. This increasing liquidity and acknowledgement of Bitcoin as part of a legitimate emerging asset class has greatly increased the future potential for cash inflows into this cryptocurrency.

Perhaps the most significant catalyst that is now rapidly emerging for Bitcoin bulls is the rise of the commercial catalyst. Square’s Q219 earnings report is only days old and it’s doubtful that this important development of a commercial catalyst has been fully factored into the Bitcoin market. Square’s revenue from Bitcoin sales on its Square Cash app doubled quarter over quarter to $125 million. Please factor in the impact that this rate of growth already is having upon the amount of Bitcoin supply available. Just one commercial app from one company, Square, is absorbing an amount that will soon approach 20% of the total daily supply of Bitcoin. Square’s consumption of Bitcoin supply appears likely to continue its rapid growth into the foreseeable future.

Growth-hungry commercial competitors have likely noticed Square’s rapid growth in revenues from the sale of Bitcoin on Square Cash. Other companies seeking growth in this space may follow Square’s lead and implement their own Bitcoin buying applications. If other commercial applications join Square’s app in absorbing the daily supply of Bitcoin, then this could reduce the amount of Bitcoin available to meet increasing demand from commercial apps for Bitcoin supply. Again, Square’s app alone will soon account for 20% demand upon the available daily supply of Bitcoin. One might envision the collective growth of demand from several competing commercial apps consuming 50% or more of the daily supply of new Bitcoin in the near future.

This emergence of the commercial catalyst may likely be a factor in what could lead to a scarcity in supply of this cryptocurrency that’s already approaching the top end of its limited supply.

Conclusion

“HODL Bitcoin!” remains a popular refrain among bulls for this cryptocurrency. Trader’s Idea Flow continues to call for new highs in Bitcoin above $20,000 in 2019 and a move to above $50,000 in 2020.

Members of our Trader’s Idea Flow community always receive our trading ideas and updates first. Traders know that timing is everything. Receiving information early and being prepared ahead of the competition is valuable. Please feel welcome to free trial our marketplace service, Trader’s Idea Flow. Just one successful trading idea can cover the cost of many years of the very affordable subscription price.

Original story: https://seekingalpha.com/article/4282164-bitcoins-newly-emerging-commercial-application-catalyst-power-new-highs