Bitcoin Volatility Reached Its Highest Since November This Week

Story by: Charles Bovaird

Bitcoin prices have enjoyed notable gains lately, rising more than 25% since the start of the year.

The digital currency reached $9,009.53 this morning, its highest since November 11th, CoinDesk figures show.

The cryptocurrency attained this 2020 high after rising to nearly $8,900 on January 15th, falling back to less than $8,600 and then mounting a subsequent recovery, additional CoinDesk data reveals.

Analysts cited many variables when explaining bitcoin’s so-called New Year’s rally, including Iranian tensions, anticipation surrounding the upcoming halving and the perception that the digital asset was oversold when the New Year began.

[Ed note: Investing in cryptocoins or tokens is highly speculative and the market is largely unregulated. Anyone considering it should be prepared to lose their entire investment.]

Rising Volatility

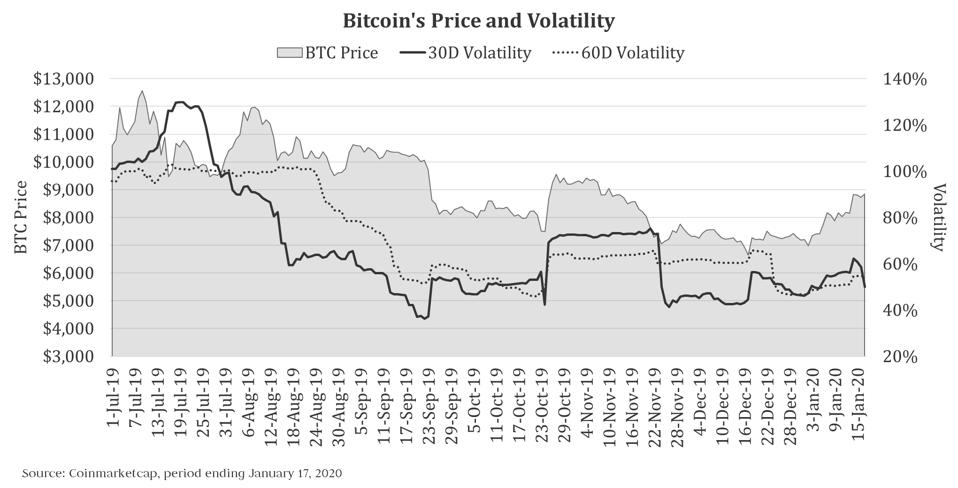

As bitcoin rallied this year, the digital currency’s 30-day volatility climbed as well, reaching its highest in more than seven weeks on January 14th, according to figures provided by independent cryptocurrency analyst David Martin.

PROMOTED

On that particular day, bitcoin’s 30-day volatility rose to 62%, its highest since November 23rd, said Martin.

While this figure represented the highest value of 2020, it was still slightly below the cryptocurrency’s average volatility reading of 63% over the last six months.

In other words, bitcoin’s price volatility has picked up lately, but this was after the digital asset was relatively stagnant for the last few weeks of 2019, trading primarily within a relatively modest range between $7,000 and $7,500, CoinDesk figures show.

Bitcoin’s price, 30-day and 60-day volatility.

DAVID MARTIN

Altcoin Rally

One factor that analysts have cited as bolstering both the price of bitcoin and the broader digital currency markets is the rally in altcoins (cryptocurrencies other than bitcoin) that took place earlier this week.

Several of these digital assets enjoyed compelling gains, with bitcoin SV, an offshoot of the original bitcoin, skyrocketing more than 200% in a matter of days on CoinMarketCap.

This sharp run up was attributed to rumors that Craig Wright, an Australian computer scientist who claims he created bitcoin, received keys to the s0-called Tulip Trust, an entity that supposedly contains over 1 million bitcoin.

While Bitcoin SV’s response was clearly significant, the run up was entirely speculative, said Tim Enneking, managing director of Digital Capital Management.

Skyrocketing Interest In Altcoins

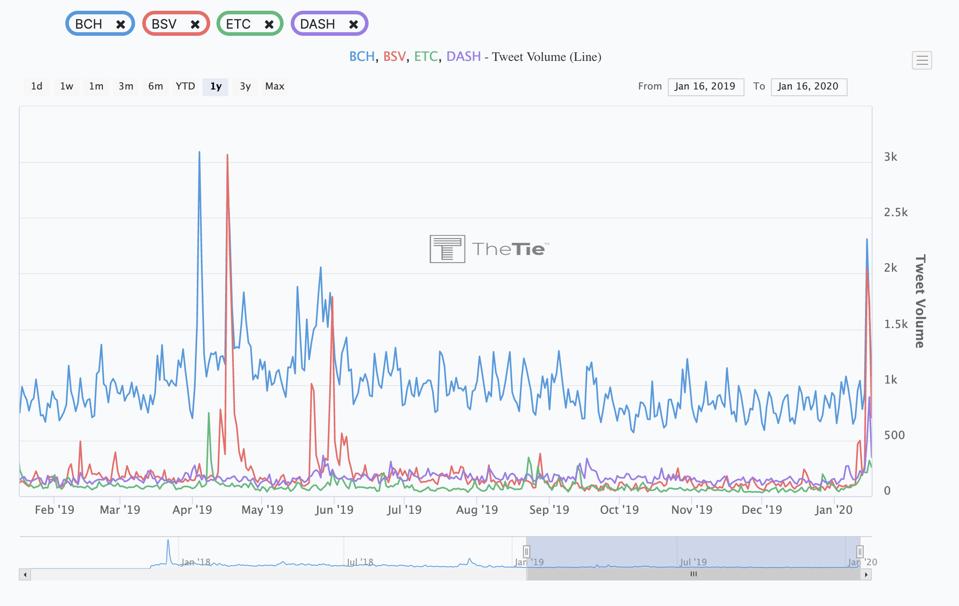

The interest in many prominent altcoins has surged lately, according to data on social media activity provided by digital analytics platform TheTIE.io.

This robust activity helps provide a sense of the interest that traders have in these digital assets.

“We are seeing absolutely massive spikes in the number of twitter users discussing altcoins,” said Joshua Frank, cofounder of TheTIE.io.

“BCH, BSV, ETC, and DASH which have all hit their highest tweet volumes since last summer,” he stated.

“Bitcoin Cash, for example, exceeded 2,000 daily tweets on January 13th for only the second time since December 2018.”

The chart below helps illustrate this activity:

This chart shows the twitter activity surrounding some prominent altcoins.

THE TIE

Market Outlook

In the short-term, bitcoin prices may consolidate for a while, trading within a reasonably narrow range until one or more developments cause it to break to the upside or the downside, according to technical analysis provided by Joe DiPasquale, CEO of cryptocurrency hedge fund manager BitBull Capital.

“Bitcoin started January around $7,200 but quickly rose above the resistance levels at $7,500, $7,700 and $8,000 by January 8, 2020,” he noted.

“After that move, Bitcoin price continued to test the new support levels (previous resistance levels) at $7,700 and $8,000, before going on to try the next resistance zone between $8,700 and $9,100,” added DiPasquale.

“For now, the price has decent support at $8,500 with the 150-day moving average, but the RSI is entering overbought territory, which indicates we may see further consolidation in this range in the absence of market catalysts,” he stated.

Going forward, bitcoin will trade between its support at $8,500 and its immediate resistance $9,100 “in the absence of market catalysts,” predicted DiPasquale.

Original story: https://tinyurl.com/w8mds7w