Bitcoin price prediction: Beware, tight range ahead – Bitcoin confluence

Story by: Tanya Abrosimova

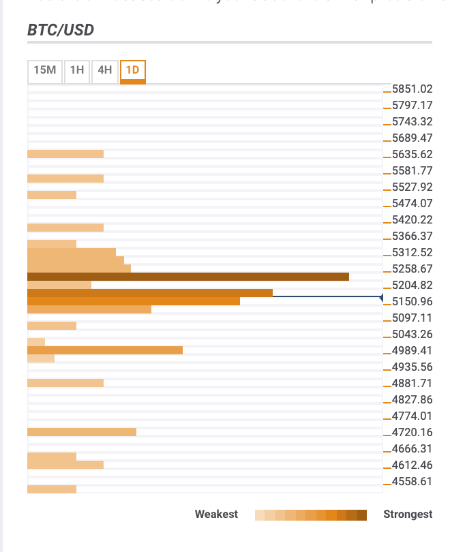

- BTC/USD bulls need defend $5,100.

- The resistance area $5,200-$5,250 is a hard nut to crack.

Bitcoin (BTC) is locked in a tight range limited by $5,100 on the downside and $5,200 on the upside. The first digital coin has been sidelined since the weekend, following a strong downside movement on Thursday, April, 25.

Bitcoin confluence levels

Bitcoin bulls may have a hard time pushing the price above the said barrier as there are a lot of strong technical levels clustered above the current price. We will need a strong catalyst to break above $5,200-$5,250 area; however, once it happens, the upside momentum is likely to gain traction.

Resistance levels

- $5,200 – SMA100 (1-hour), middle line of 1-hour Bollinger Band, middle line of 15-min Bollinger Band, 61.8% Fibo retracement daily, SMA200 15-min, SMA10 and SMA5 4-hour.

- $5,250 – upper boundary of 1-hour Bollinger Band, middle line of 1-day Bollinger Band, 38.2% Fibo retracement weekly, SMA100, 1-hour

- $5,400 – 61.8% Fibo retracement weekly.

Support levels

- $5,150 – 23.6% Fibo retracement weekly, 23.6% Fibo retracement daily, lower boundary of 1-hour Bollinger Band, 38.2% Fibo retracement daily, lower boundary of 4-hour Bollinger Band

- $5,000 – lower line of 1-day Bollinger Band, Pivot Point 1-day Support 3.

- $4,700 – Pivot Point 1-month Resistance 3.

BTC/USD, 1-day

BEST BROKERS TO TRADE CRYPTO

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress.

Original story: https://tinyurl.com/yycaptqa