Bitcoin Could Be About To Make A Significant Move

Story by: Billy Bambrough

Bitcoin and cryptocurrency investors have been closely watching the market over the last few weeks, with November and December a historically key time for major market moves.

Last November, the bitcoin price halved from around $6,000 per bitcoin to just $3,000, while the year before November kicked off bitcoin’s epic bull run to almost $20,000.

The bitcoin price has historically moved sharply towards the end of the year but there’s no … [+]

SOPA IMAGES/LIGHTROCKET VIA GETTY IMAGES

Looking further back, November 2013 saw the bitcoin price suddenly climb from around $200 per bitcoin to over $1,000 by the middle of December.

Bitcoin traders have noticed the pattern, though have struggled to explain why the price seems inclined to move suddenly in the final couple of months of the year.

“A year ago, today was the day bitcoin started its drop from $6,000 to $3,000,” one prominent bitcoin and crypto trader wrote on Twitter yesterday. “Two years ago, today was the day bitcoin started its parabolic rise from $6,700 to $20,000.”

Others cautioned against making bets the market will move again this year, with bitcoin and crypto market analyst, previously of brokerage eToro, Mati Greenspan warning, “both [the 2017 and 2018 bitcoin spike and slump] were irrational and unexplainable moves that were eventually reversed by the market.”

PROMOTED

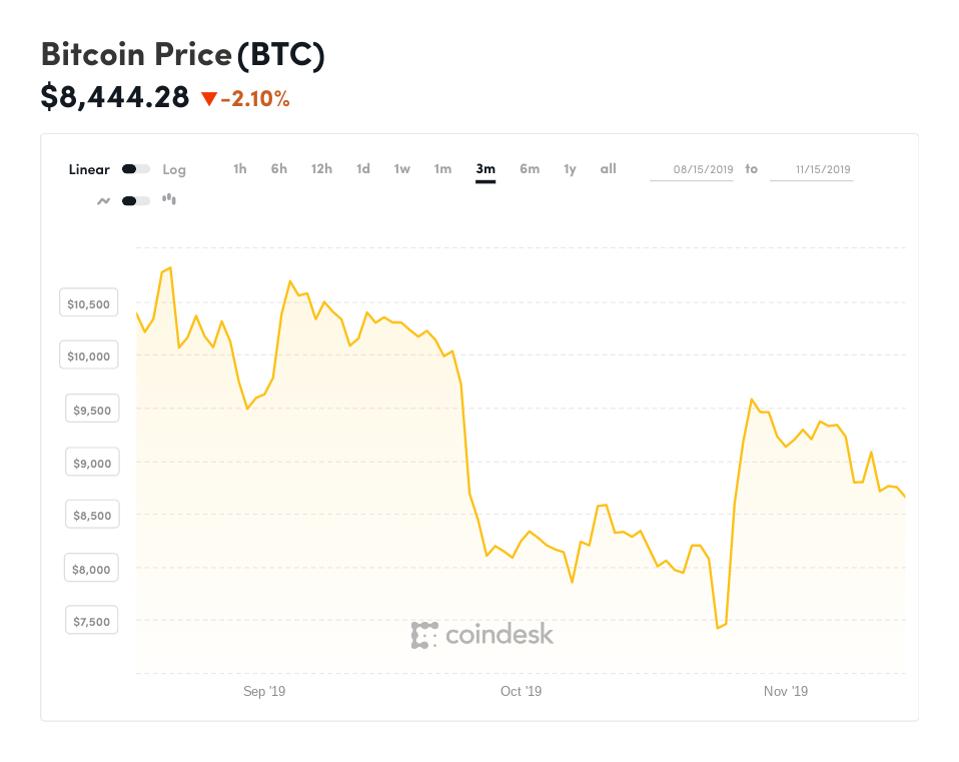

The bitcoin and cryptocurrency market has been sliding so far this November, with the bitcoin price down some 6% since the start of the month.

In October, after weeks of stagnation, the bitcoin price suddenly dropped only bounce higher again a couple of days later, leaving many bitcoin and crypto analysts scratching their heads over the exact cause of the extreme market volatility.

The bitcoin price has continued to swing wildly despite hopes the market would have calmed and … [+]

COINDESK

Meanwhile, technical data suggests bitcoin could be heading into rough waters, with a closely-watched chart shrinking to its narrowest since June.

The tightening of the trading range between bitcoin’s 50- and 200-day moving averages could trigger a sell signal, it was first reported by Bloomberg, a financial newswire–with one analyst seeing echos of last November’s sell-off.

“The best way to describe the market is it’s retracing last year’s bear market,” said Bloomberg Intelligence analyst Mike McGlone.

“It’s in no hurry to take out the old highs—there’s a hangover of residual selling from the parabolic rally in 2017. There’s just a lot of people who bought it, got way too overextended, who will be responsive sellers.”

Original story: https://tinyurl.com/u7p9k9z