Bakkt Bitcoin Trading Volume Suddenly Explodes, Jumping 800%

Story by: Billy Bambrough

Bitcoin futures coming to the Bakkt trading platform was expected to be one of the biggest events in the crypto calendar this year.

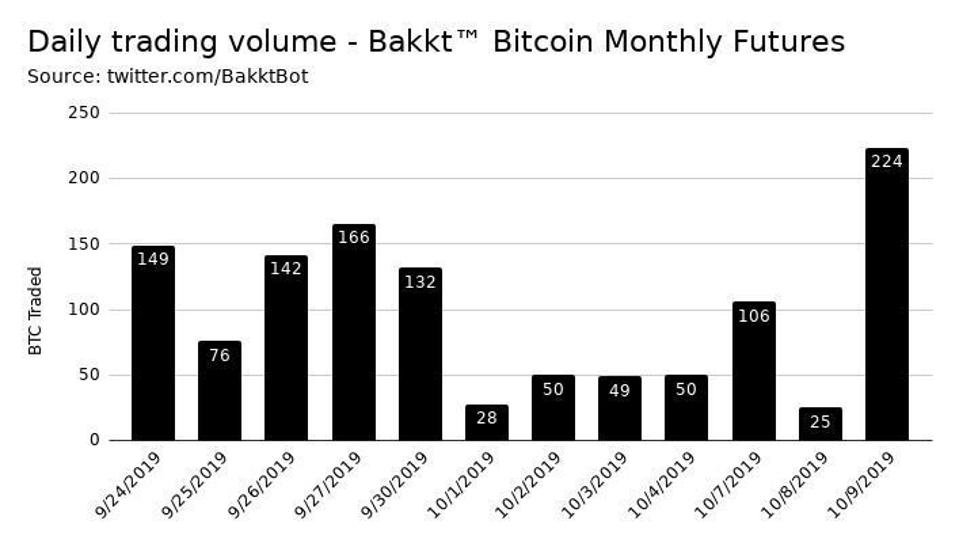

Now, after a slow start, bitcoin futures contracts being traded on the Intercontinental Exchange-backed bitcoin and crypto platform finally appear to be picking up–recording a daily increase of almost 800% earlier this week.

The bitcoin price has been swinging wildly over the last few weeks as bitcoin and crypto traders seek direction.

SOPA IMAGES/LIGHTROCKET VIA GETTY IMAGES

“As we continue to build the Bakkt bitcoin futures contract, we reached a new trading record of 212 contracts traded [on Wednesday],” Bakkt said via Twitter.

“With [Wednesday’s] close, Bakkt set a new daily record of $1.93 million, bringing its total number of outstanding contracts to 1197 as of October 9, worth $10.2 million.”

The 796% surge in Bakkt daily volume came as the bitcoin price rebounded somewhat after a significant sell-off at the end of September.

PROMOTED

Bitcoin futures contracts traded on the platform fell back on Thursday, though, recording a total of 109 bitcoin traded.

Bitcoin and cryptocurrency traders were quick to seize on the uptick in Bakkt volume, suggesting it could be a sign of coming institutional investment.

“Watch Bakkt volumes,” said Tom Lee, head of research at bitcoin and crypto data company, Fundstrat. “It is nearly a pure proxy for institutional demand for bitcoin.”

Bakkt bitcoin futures contacts hit a low of just 25 on Tuesday before leaping higher on Wednesday.

BAKKTBOT

Bakkt, an Intercontinental Exchange-backed bitcoin and crypto platform, was unveiled last year and boasted computing giant Microsoft and coffee chain Starbucks among its partners–promising to open up bitcoin to institutional investors and bring crypto spending to the high street.

Bakkt’s much-hyped “physical” bitcoin futures, meaning that traders and investors are not able to sell more bitcoin than they actually have, were expected to herald a sea-change for bitcoin markets, though they have so far failed trigger any meaningful change.

Original story: https://tinyurl.com/y44cy844