Analyst: Bitcoin Price Must Hit This Key Level to Exit Bear Market

Story by: Josiah Wilmoth

In the wake of Sunday’s crypto massacre, shell-shocked investors have been left with dashed dreams and a lingering question: Will bitcoin’s bear market ever end? Crypto brokerage BitOoda says that the answer lies in two price levels: $4,200 and $6,000 – levels with which retail buyers need to become more acquainted.

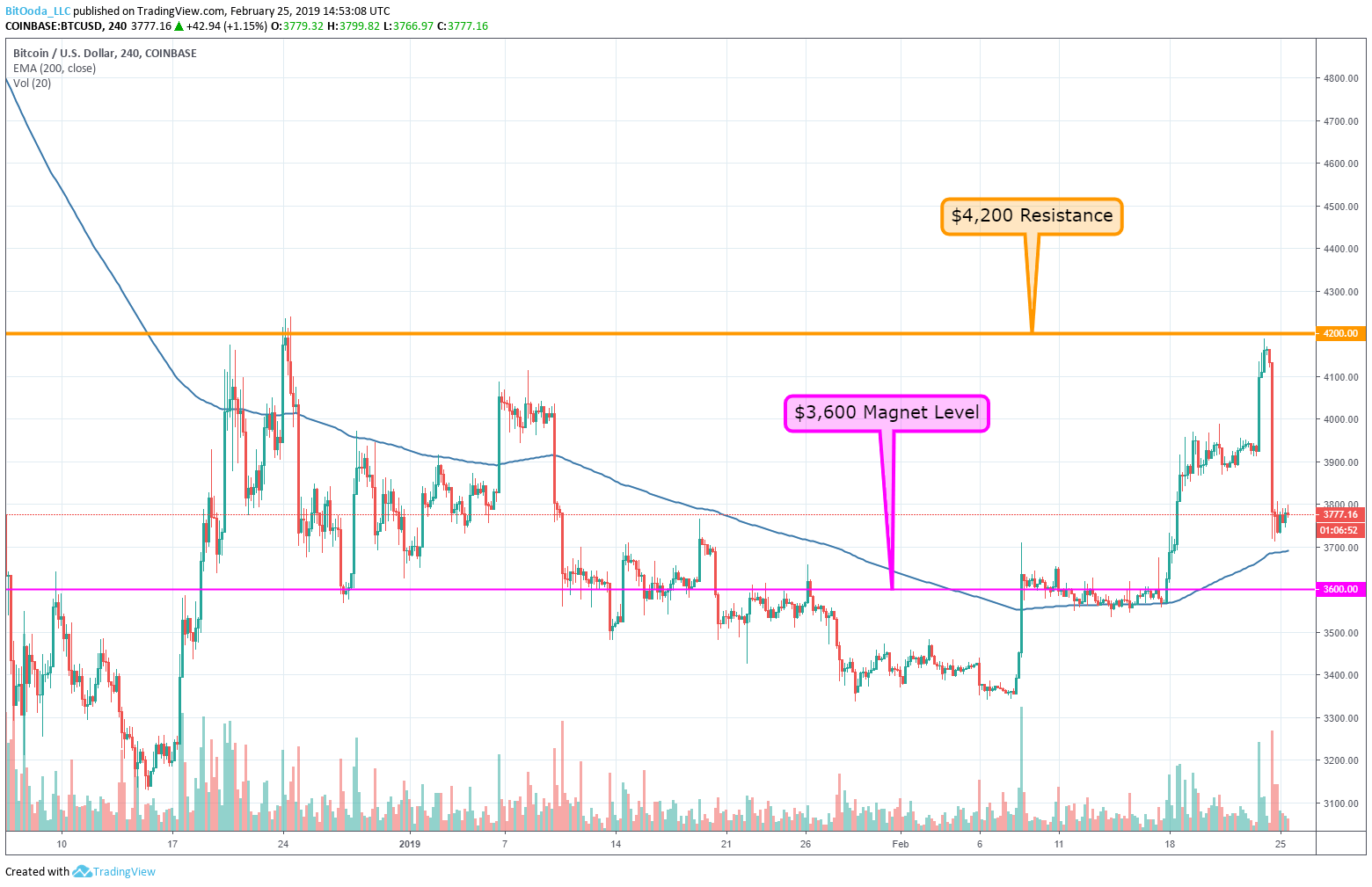

BITCOIN PRICE FACING STRONG RESISTANCE AT $4,200

Writing in a note to clients on Monday, BitOoda Executive VP of Institutional Sales Brian Donovan said that the sell-off demonstrated that the ~$4,200 level had become a significant level of resistance for the bitcoin price.

“We can see clearly now that the ~$4,200 BTC level has formed RESISTANCE, and until that level gets broken to the upside, we will remain BEARISH of the crypto space.”

On Sunday, a buoyant bitcoin made a strong run at $4,200 but ran headfirst into that resistance line, stalling at $4,190 on Bitstamp and $4,188 on Coinbase.

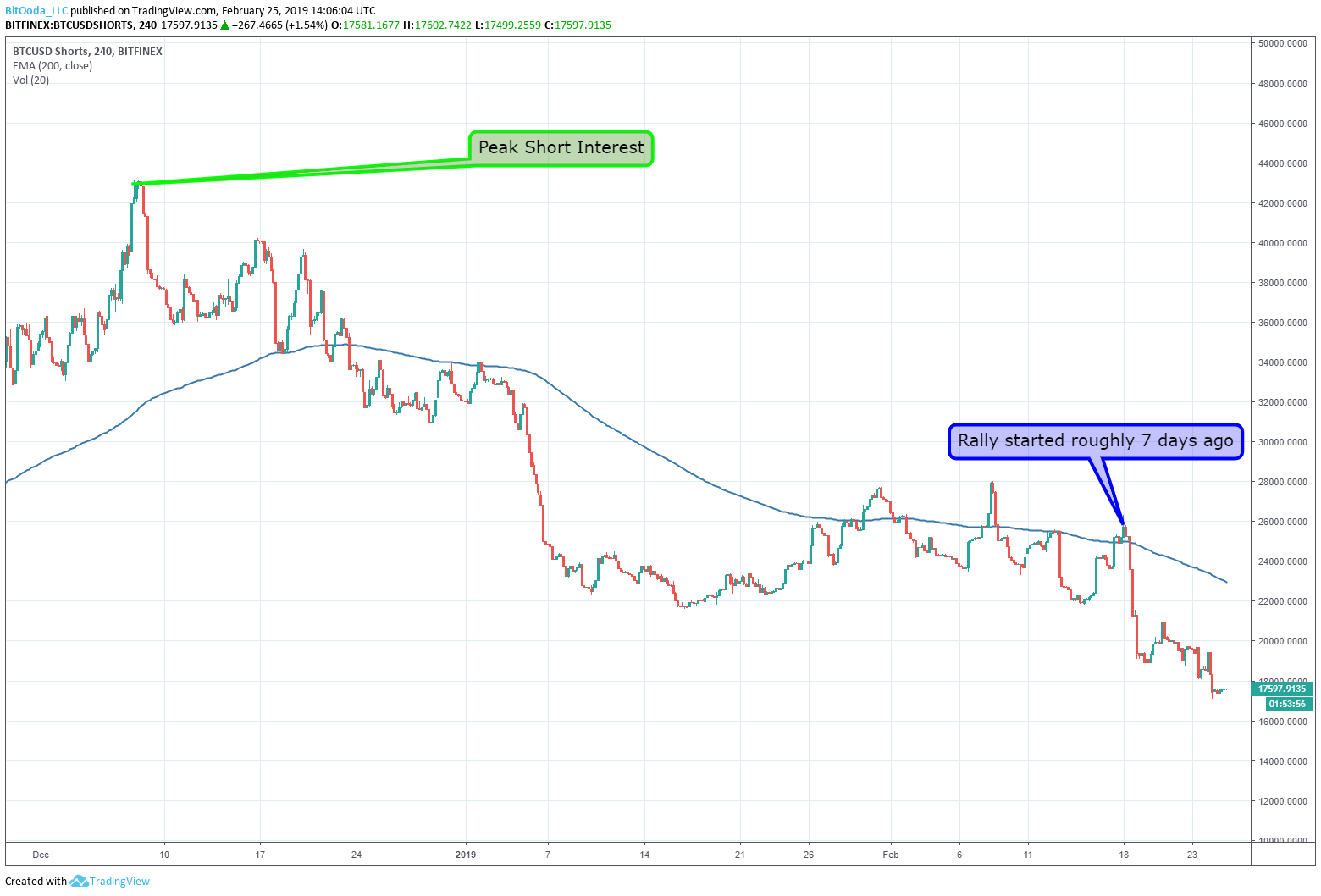

Notably, Donovan wrote that the rapid drop was likely caused by traders who were net-long on bitcoin “liquidating their inventory, with the market not easily absorbing their selling pressure. As evidence, he noted that short interest has been in decline throughout most of the year and did not increase over the weekend.

BITCOIN NEEDS TO PUT KEY $6,000 LEVEL IN ITS REARVIEW MIRROR

Zooming out, BitOoda intimated that traders and analysts who have rushed to call a bottom had jumped the gun, as the “thinly-traded” cryptocurrency market is vulnerable to severe price swings and could still go below $3,000 for the first time since 2017.

From another recent client note that came toward the beginning of the crypto market’s February rally:

Original story: https://www.ccn.com/bitcoin-price-hit-key-6000-level-end-bear-market